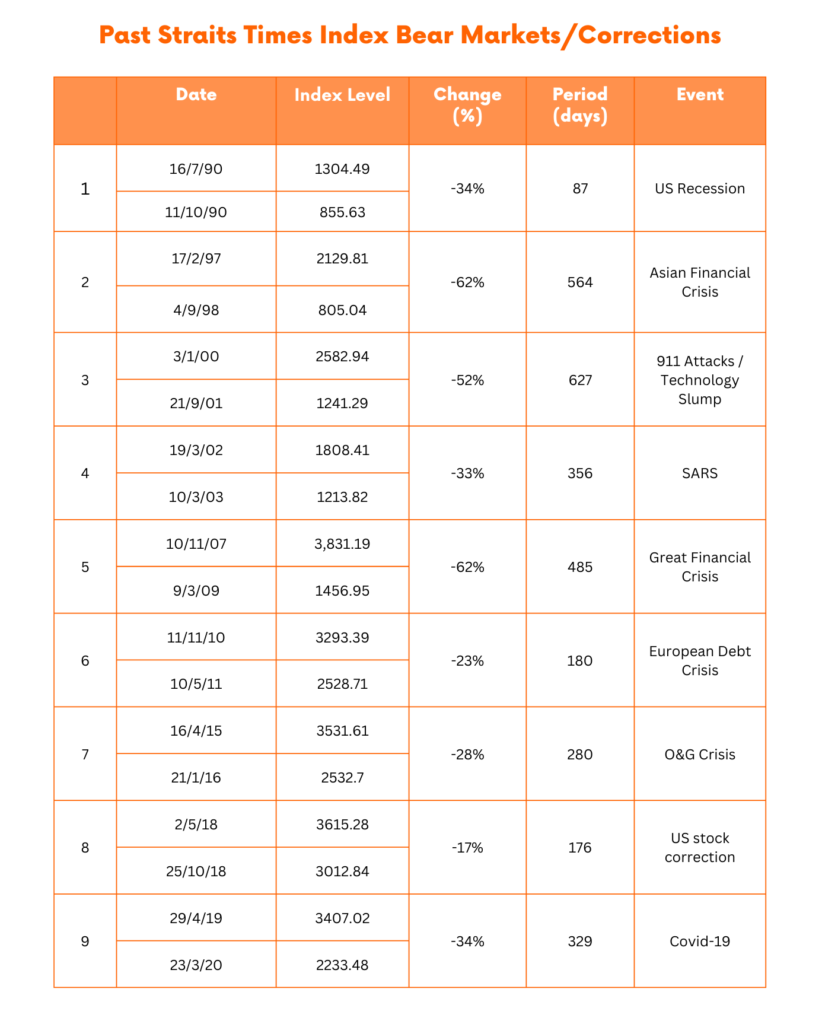

To be clear, I am not predicting a market crash. The truth is no one can predict it. That said, history can give us a glimpse into the odds of meeting one.

In the 30 years from 1990 to 2020, we have roughly seen 9 bear markets in Singapore. This means investors should expect one occurring roughly every three to four years. It does not mean that we will definitely see one happening every 3 years like clockwork but rather that a down market is more common than one would think.

I think keeping this in mind will help investors avoid FOMO during new stock highs and wait for a more acceptable risk-return.

Singapore banks are attractive after a crash

With dividend yielding 5-6%, Singapore’s banks look like an attractive dividend play. So why am I staying on the sideline?

At current valuation, future upside has largely been baked in.

High interest rates and boom in wealth business has driven Singapore’s banks assets and fee income to records in recent quarters. Demand for loans is also expected to improve following the US central bank interest rate cut and broader-than-expected monetary stimulus and property support measures in China, a key market for Singaporean banks. Global commodities also tend to rise in price as the U.S. dollar drops which will boost inflows into ASEAN economies.

Banking stocks are cyclical investments.

Loan growth parallels the economy’s performance, and things look great for now.

And this positive outlook has driven banks’ stocks prices up 30% year till date. Could it keep going up? Sure.

But things can go bad quickly when the regional economy weakens.

Given that I do not have insights whether banks can sustain their dividends for the next 5 years, I am wary of jumping onto the bullish bandwagon.

Banks dividends are also not guaranteed

Some investors may recall MAS imposed a 60% cap on dividend payouts during 2020. Although it has now been lifted, in a financial crisis MAS might impose some kind of restrictions again so that banks can rebuild capital versus paying dividends to investors.

Unfortunately, when banks cut their dividend, share price also tend to decline. This is a double whammy for investors as their dividend goes missing and their capital gets a haircut.

In contrast, after a slump, bad assets are identified and written down. Many investors become wary of touching bank stocks. This means low expectations and potentially better returns.

To be clear, I am not saying no one should invest in banks now. Each investment decision should be made based on one’s assessment of risk and returns. Some people are willing to take more risks for higher returns and that is perfectly fine.

Banks sound risky. Why still invest in banks?

As small retail investors, we typically do not have the opportunity to invest in the tens of thousands of small businesses that are the lifeblood of the economy. These are small businesses that provide vital services, such as our F&B restaurants, salons and other small retailers, which will continue to improve when an economy recovers. But because these businesses are not publicly traded, retail investors often miss out on the gains during an economic recovery.

But a bank does. A share in a bank becomes as a proxy for investing in the economy as a whole and can give wonderful returns.

Of course, this doesn’t mean all banks are good investments. But it will be good to start studying them now to learn how to identify those that will survive and recover after a slump.

Photo by Peter Nguyen on Unsplash