Disclosure: I currently own shares in Sheng Siong Group.

The US Fed finally announced their rate cuts. So begrudgingly, I started to research on alternative investments that could yield a good interest income without compromising on safety.

TLDR: I find Sheng Siong’s stock offers a defensive dividend with some potential for growth. But I am mostly starting a position in it for its dividends. Any growth will just be a nice bonus.

Main reasons why I find Sheng Siong’s stock attractive:

- Strong management that is aligned with shareholders will ensure the sustainability of the business and dividends payout.

- At current price of $1.50/share(at date of research), Sheng Siong (SSG) could provide a good dividend yield between 3%-4% going forward. In comparison, the latest 1-Year Singapore T-bill yields 3.38% and is expected to trend lower since the US Federal Reserve is expected to lower interest rates further. Given the stability of the grocery supermarket business in Singapore, the additional yield looks attractive.

- Even in downturns, people still need to buy for groceries and basic needs. Sheng Siong is likely to survive even in an economic downturn.

If you’re interested in the more detailed aspects of my research, continue below!

Disclaimer:

Singa Polah is a lion. Not a financial advisor/accountant/lawyer. The articles are written based on what Singa Polah has researched and should serve as financial education, not financial advice. Information can become outdated as market changes.

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.

Company Background

Sheng Siong has leapfrogged from a humble provision shop in Ang Mo Kio in 1985, into one of the largest supermarket chain in Singapore today.

Known for its low prices and a unique mix of fresh and dry products in a supermarket setting, this strategy has been successful in capturing the lower- to middle-income consumer segment in the HDB estates.

Over the years, it has grown to 71 stores with a gross profit margin of 30% through a selling more of higher-margin fresh food and house brands products. While increasing manpower costs continue to add pressure on operating profit margin, greater store openings could help to keep net profit growing.

Macroeconomic Trends

- Population Growth

Total population growth is a key driver of grocery retailers’ revenues. Singapore’s total population growth is expected to average 1.0% over the next five years, providing the industry with a stable base level of growth.

- Government payouts

The Singapore government has planned a series of payouts to help support citizens. These includes:

– Assurance package: Cash payout ranging from $700-$2250 for adult Singapore citizens over 5 years from 2022 to 2026, and ad additional $300 for seniors

– GST rebate: Cash payouts of $450 or $850/year

– CDC shopping vouchers: a total of $800 CDC Vouchers in 2024, and $300 CDC Vouchers in 2025 to be spent at participating heartland merchants, hawkers, and participating supermarkets.

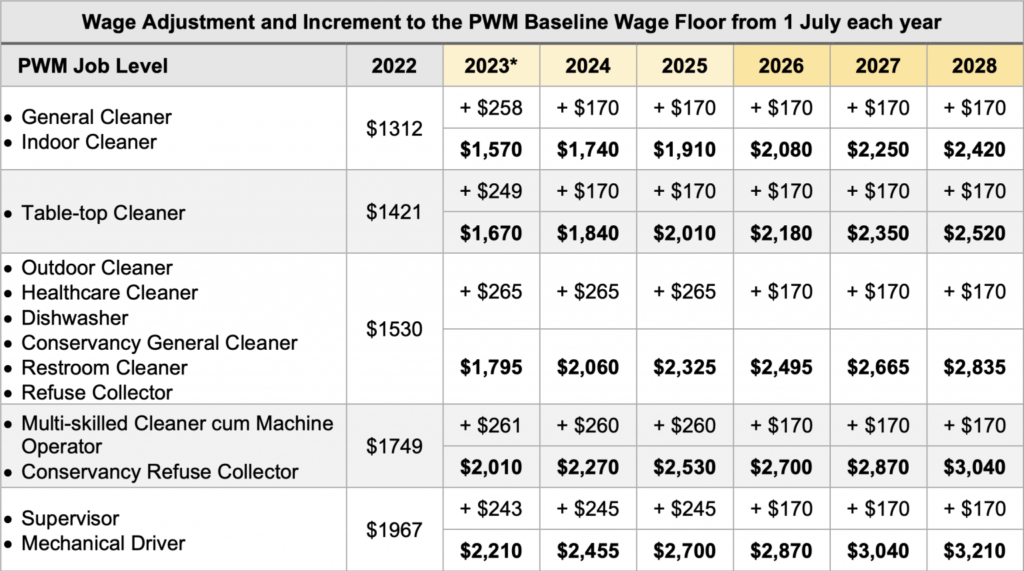

- Singapore’s Progressive Wage Model

To help improved the pay of low-wage workers in Singapore, the government has been progressively rolling out this policy across different sectors. This boost in income could see greater consumption of groceries and basic necessities.

- Inflation/Recession

From the conflict in the Middle East to the Ukraine war, there remains a great deal of uncertainty in the global economic environment. Should the world/Singapore enter a prolonged inflation/recession, we would expect investors to increase equity allocations to defensive names and price-conscious consumers to trade down to alternative value- for-money grocery retailers like Sheng Siong.

Industry Overview and Competitive Positioning

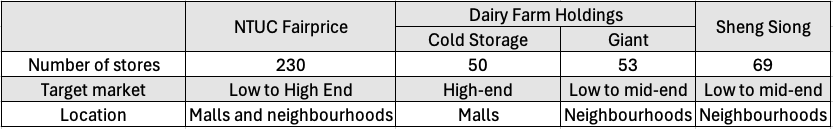

Singapore’s grocery retail market was worth US$6.6 billion in 2023 and is expected to grow to US$7.7 billion in the next 5 years, reflecting 3.1% compound annual growth rate (CAGR). The highly competitively industry dominated by top 3 players.

In September this year, Giant announced that it will closed its 9th stores in Singapore, leaving 45 stores remaining. As rising costs and competition intensify, this will benefit the low-cost leader as more exit under the cost pressure.

Sheng Siong is also somewhat insulated from the onslaught of online supermarkets like Redmart and Shopee mart. In a 2023 industry study, they found that

- three in five often remain short on supplies despite shopping online

- And majority of households have not found an effective method to remember to restock their groceries

This means that brick-and-mortar supermarkets remains dominant. Importantly, Sheng Siong’s focus on fresh produce near one’s doorstep continues to be a strong advantage over online-only peers.

Other new supermarket entrants also tend to focus on the more affluent segment of the population and target the mall-goers. From Scarlett, the Chinese supermarket to Don-don Donki, the Japanese retailer, new stores tend to compete with NTUC and Cold Storages which are located in the same malls.

In contrast, Sheng Siong continues to expand its presence in HDB neighbourhoods. Neighbourhood stores tend to be smaller and cheaper than mall spaces. This saves money on leases and utilities. The layout at SS with its cramped aisles maximises retail space.

Another key tactic that SSG use to aid their low-cost image is ‘Known Value items’. These are staple household products whose prices people often remember. When people see lower prices for staple goods, they infer that the business offers low prices all around. This is achieved through regular market research and benchmarking to ensure Sheng Siong provides the best value in a basket of essential goods.

SSG also prices its items at each outlet differently depending on location and surrounding competition. In contrast, its main competitor, Fairprice follows uniform pricing for its goods across all stores. This price discrimination allows SSG to maximise profit for each store.

Could new supermarkets copy Sheng Siong’s strategy?

Certainly. But SSG being the first-comer has built up significant scale. This enables greater cost savings whether from negotiation with suppliers to spreading out the cost of automation.

That said, the increase competition has pushed up rental for HDBs stores and will continue to put pressure on operating profits.

Management is also prudent and knows how to manage competition.

SSG was born out of a series of crises.

“The founder of the Sheng Siong chain, Lim Hock Chee, first worked on his family’s pig farm, Cheng Siong Pig Farm. The farm, which reared 3,000 pigs at its peak, had to close when the government started phasing out Singapore’s pig-farming sector in the early 1980s. In 1984, when the farm was stuck with an excess of unsold meat, Lim saw an opportunity when he visited a provision store in Ang Mo Kio that did not sell pork. He set up a pork counter at the Savewell Supermarket and paid the store’s owner 20 percent of sales revenue as rental.

The Savewell chain of stores ran into financial trouble the following year, and its outlets were put up for sale. Despite having no experience in running a provision store, Lim borrowed S$30,000 from his father and bought the 1,650-square foot Savewell outlet in Ang Mo Kio for S$20,000 from its owner, Aw Chwee Seng. Assisted by Savewell employee Lim Gek Heng, Lim ran the first Sheng Siong store with his two brothers, six sisters and four workers. Sheng Siong faced stiff competition as there were five other provision stores within walking distance of it, but the store focused on providing a wide range of no-frills products and increased sales volumes by accepting lower profit margins. By 2004, only one of the competing provision stores near its Ang Mo Kio outlet remained.”

Source: https://www.nlb.gov.sg/main/article-detail?cmsuuid=034bf670-569d-46f5-9813-2c0289ffee3e

With their in-depth understanding of the local fresh produce supply chain, management continues to compete effectively as the low cost industry leader, and is not seeking growth recklessly.

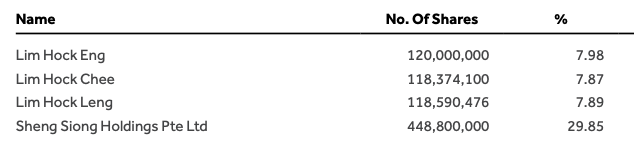

Management also holds around 53.7% of total shares, which aligns their incentives with other investors. The total number of shares have also been constant since 2014.

Keeping margins competitive

SSG also has the ability to invest to further improve its efficiency.

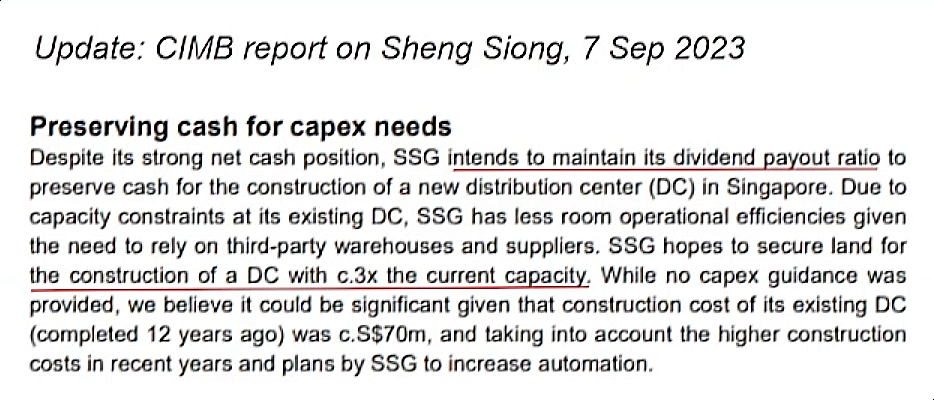

In a CIMB report on Sheng Siong (7 Sept 2023), management has shared capacity constraints at their existing distribution center(DC) and plans to build a new one that would reduce its warehousing costs.

Potential downsides

- SSG as a family business may suffer when there’s internal division

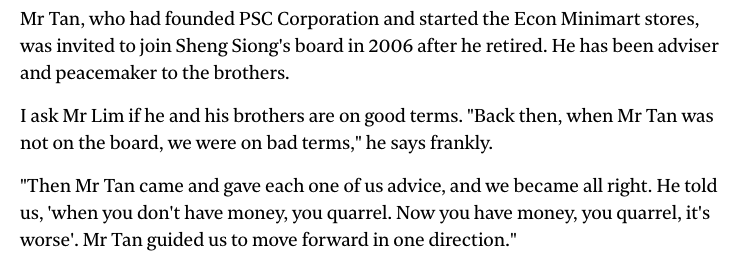

Luckily, management is cognisant of the importance of having outsider advisor to help mediate troubles. Currently, the vice chairman serves that role as mentioned below in an interview:

- Succession plans

The current management are in their 60s but they have been grooming the second generation to pick up the ropes. In various interviews, they have mentioned that they were open to seeking outsiders to run the business if the second generation Lims are unable to perform to task.

Sustainability of SSG as a dividend play

Management has done an excellent job growing and operating as one of the most efficient grocers out there. Even as competition intensifies, SS has the scale advantage as well as niche positioning to protect its market share.

With its economic moat and strong management, SSG is a stable business that offers an attractive play for those with looking for a good dividend income stock.

At current price, dividend yield is 4% which is a good 1% over SG t-bills. This a good point to add some shares to the portfolio and perhaps to buy more if prices do fall further.

Some speculation on future growth

Many believe that the market for SSG’s growth potential has become saturated. Afterall, Singapore is a small market. But I believe there are still various ways for SSG’s business to expand.

Local expansion

SSG current store count is around 10% of total supermarket outlets in Singapore. With ample cash and shrewd management, I would not be surprised if they can take more market share, especially as Dairy Farm undergo a multi-year transformation plan which includes culling stores’ performance that it feels cannot be improved.

A pickup in new HDB estates built-out will also increase the number of stores SSG can tender for.

Till date, Sheng Siong has won 4 new tenders with a few more pending results.

Higher-margin supplements/ OTC drugs

Grocery business is a high frequency purchase because people need to eat every day and they will need some of those basic items to make food frequently. That frequency can turn into other sales of higher margin items. Supplements and over-the-counter drugs also do not take up much shelf space.

Possible Merger/Acquisition Targets

Other neighbourhood stores that focuses on the budget shoppers that comes to mind is Venus Beauty and Beauty Language. These sell higher margins beauty products and healthcare supplements at prices 20% cheaper than larger counterparts. This could help SS expand into beauty and personal care, avoiding possible cannibalising existing sales.

Overseas expansion

SSG has also managed to grow their supermarket outlets in China from 2 to 6. While it’s still early days, being profitable and expanding in numbers is a good sign.

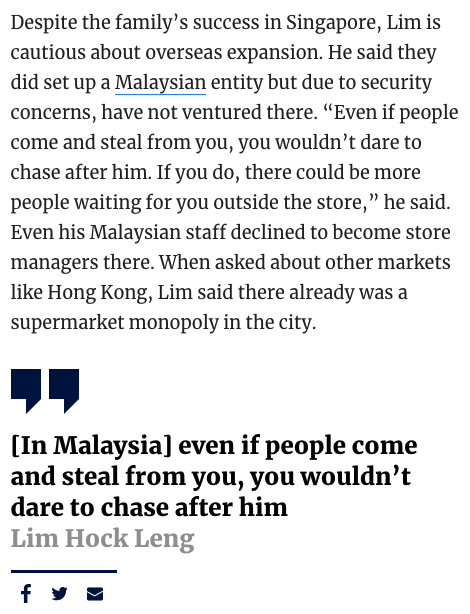

Unfortunately, SSG were not able to expand into Malaysia due to security concerns. In an interview, the management shared that:

Otherwise, we might have taken some shares from Malaysia’s 99 Speed Mart Retail, which boasts 2,542 outlets in Malaysia with aims to reach 3000 in 2025. But this is just pure speculation on my part.

Conclusion

Of course, there is no guarantee how long it will take for management to grow significantly. So I would buy SSG at current prices for its dividends and any upward capital appreciation would be a nice bonus to have.

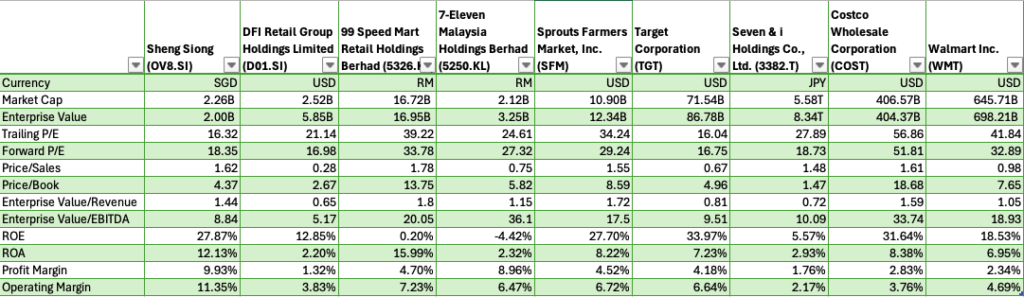

Peers Comparison