If you have a savings bank account, you’re already investing.

Finance people likes to come up with all sorts of jargon to convince you to pass your money to them. But money management and investing doesn’t have to be hard.

Here’s a simple way to understand it.

Investing is like renting out a house. Some of us have small houses, some of us have big houses. When we rent it out, tenants pay us rent for the use of our house. So rent is the return we get.

Now, replace the house with your money.

When we lend out our money, the banks give us interest. And interest rate is the amount we get for every dollar we invest. This way, we can compare between different borrowers and know who gives us the best return.

What if we choose to lend to others instead of a bank?

If you are lending money to the government, it is called buying a treasury.

Lending money to businesses instead? This is called a bond.

Stocks are a bit different because you are essentially buying a part of the business. But you buy it in the hopes that one day the business will go bigger and the piece that you own will be worth more than when you have bought it.

And that is what investing is mostly about. It is the lending out of some assets like your house, your car or your money, in exchange for some return.

So when we put our money in a savings account, we are already an investor even if we didn’t realize it.

But wait a minute. Isn’t investing about making millions from stocks like Warren Buffett? If we are already investing, why we don’t get rich from putting our money in the bank?

Before we can explain why some people get rich, we need to first understand how interest works.

There are two types of interest: simple and compound.

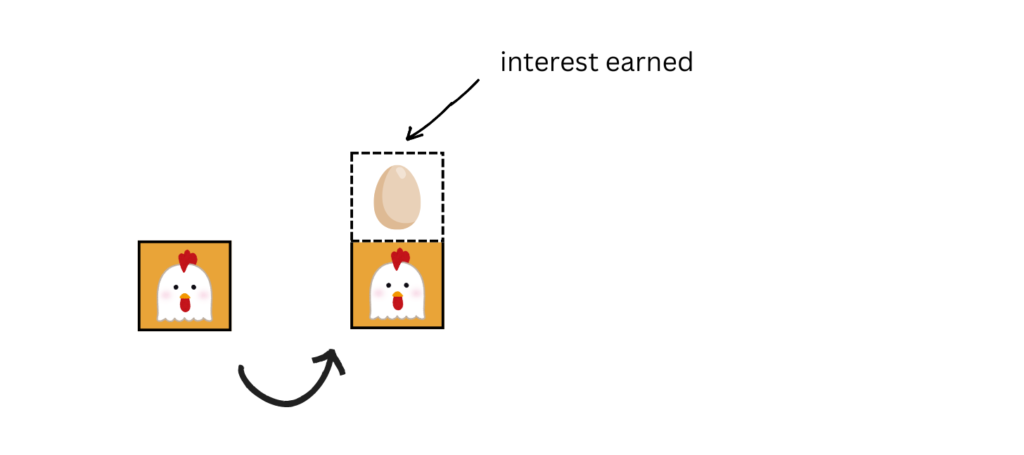

To understand their difference, let’s imagine that you own the hen below. This is like the money you have initially. Finance people like to call this ‘the principal’.

If you feed it well, it gives you an egg! This is like earning an interest on your principal money.

Because each egg will become another hen, you now have double of what you originally had (+100%)!

But let’s say you decide to eat the egg instead. You still have the original hen which continues to lay an egg each time.

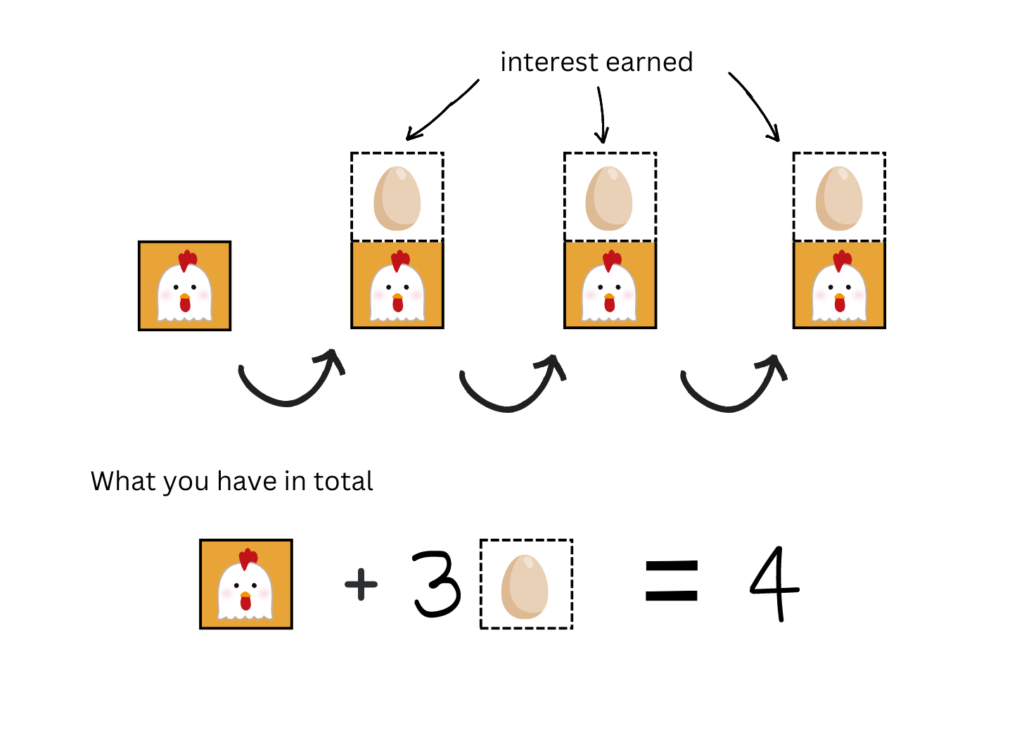

If you take out the egg/interest earned each round and leave only the hen/principal to grow, you will end up with four times what you had! This is simple interest.

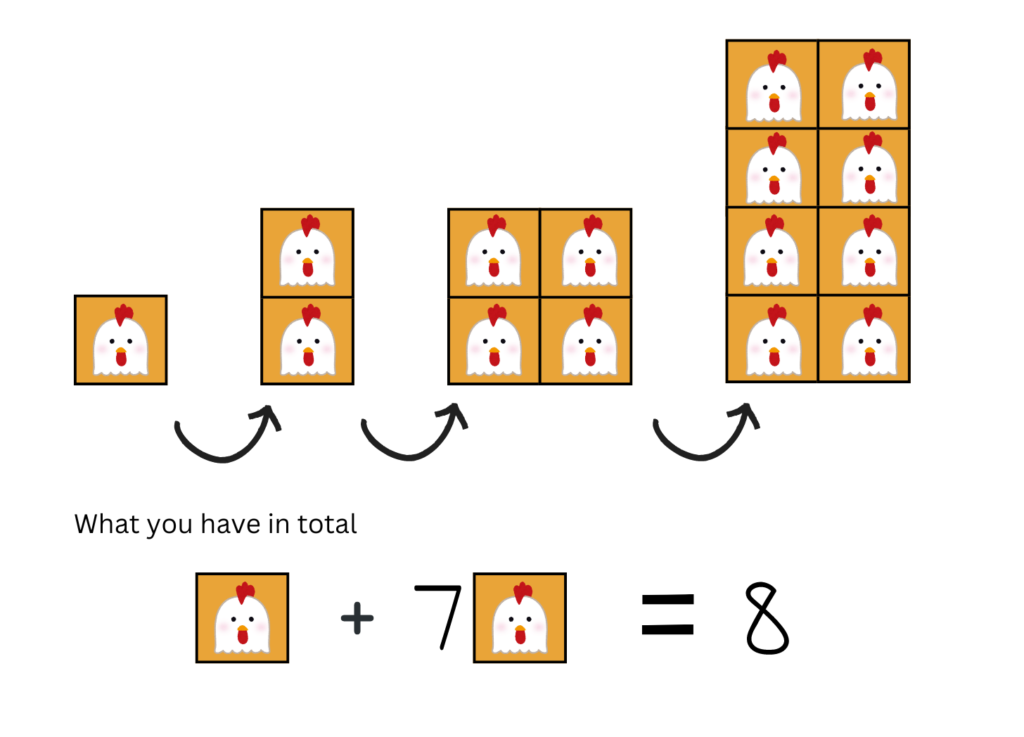

What happens if instead of taking out the egg/interest, you let it grow together with the original hen/principal?

With just 3 rounds, you would have ended up with eight times more of your hen/money.

Because each hen lays an egg which becomes another hen which lays another egg, and the process keeps expanding the number of hens around.

Compound interest is then simply making more interest from interest.

No wonder people say money makes more money!

But I am not done yet. What happens if we let it grow for a few more rounds?

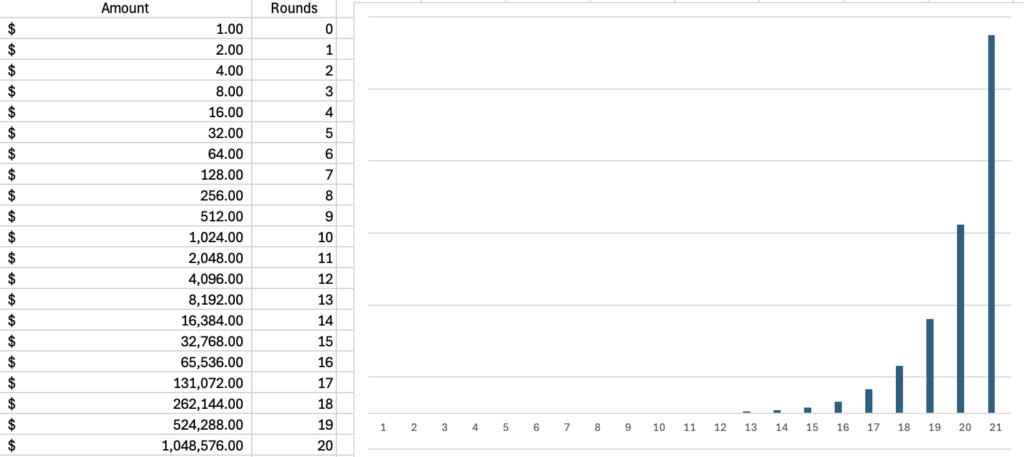

If we replace each hen with $1, and let it compound, we will make a million dollars by 20 rounds. And look at the right side of the graph. It is only twice of the previous amount, but it is a million times more than what we started with. In fact, we could barely see the amount on the graph because it was so small in comparison.

This is the magic of compound interest.

But isn’t this all just theoretical? Surely, we don’t get this kind of growth in real life for money?

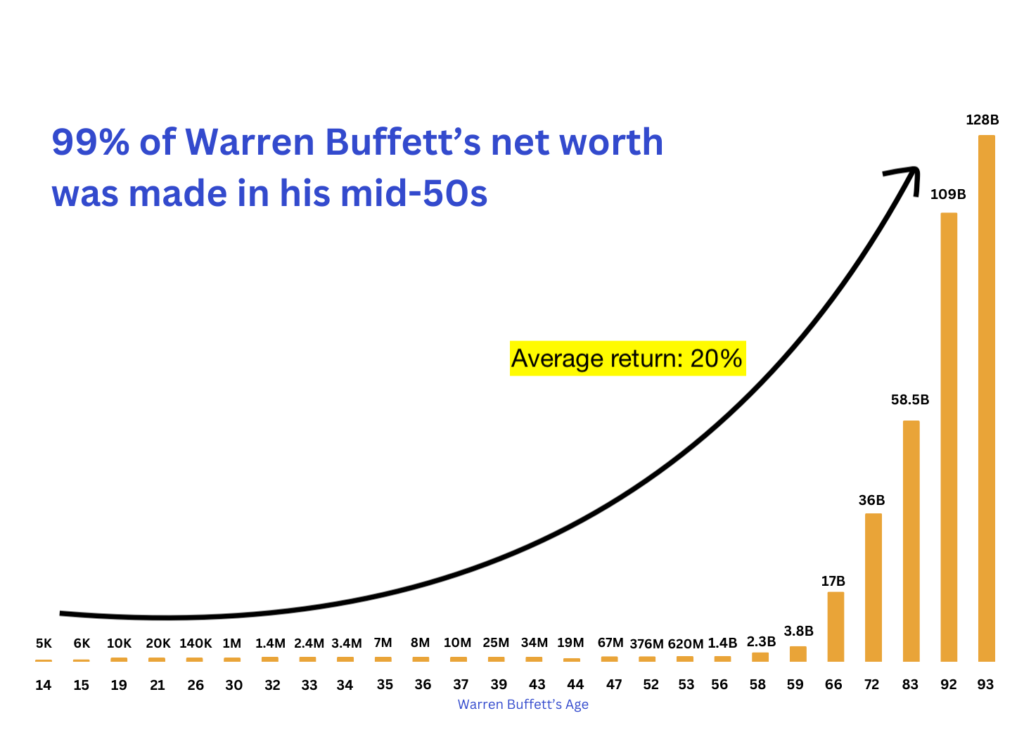

I have used a high growth rate just to illustrate the point. But here’s what Warren Buffett, the legendary investor’s money looked like at different ages.

I feel like I have seen this graph before.

Of course, Warren Buffett is exceptional. But not because he makes the highest return on his money. There are investors like Jim Simmons who make 66% for 30 years and still didn’t beat Buffett. It’s the time Buffett has spent compounding his money consistently while making his methods known. Beginning at 14, he has had compounding interest working in his favour for 79 years and still going!

The effects of compounding is hard to detect in our daily life.

We often missed out on how small changes because they don’t seem to matter very much in the moment. Save a little money now, you’re still not a millionaire. Cut down the number of bubble tea you drink this week, you still weigh the same. Success requires long-term habits, not short-term change.

Yet, if the secret is being consistent, why does no one ever gets rich from putting their money in the banks?

That’s because the interest rates they offer is so little that it will take a very long time to compound to a substantial sum. While the rates have been higher recently, just a few years ago, banks were offering ~0.2%. Yes, I didn’t write that wrong. We were lending out our money almost for free!

How to Become a Millionaire in 35 years

While most of us are not going to be like Warren Buffett, it is surprisingly not that hard to try to become a millionaire if you have time on your side. (Not that we have to be. It is just easier to demonstrate the principles of investing.)

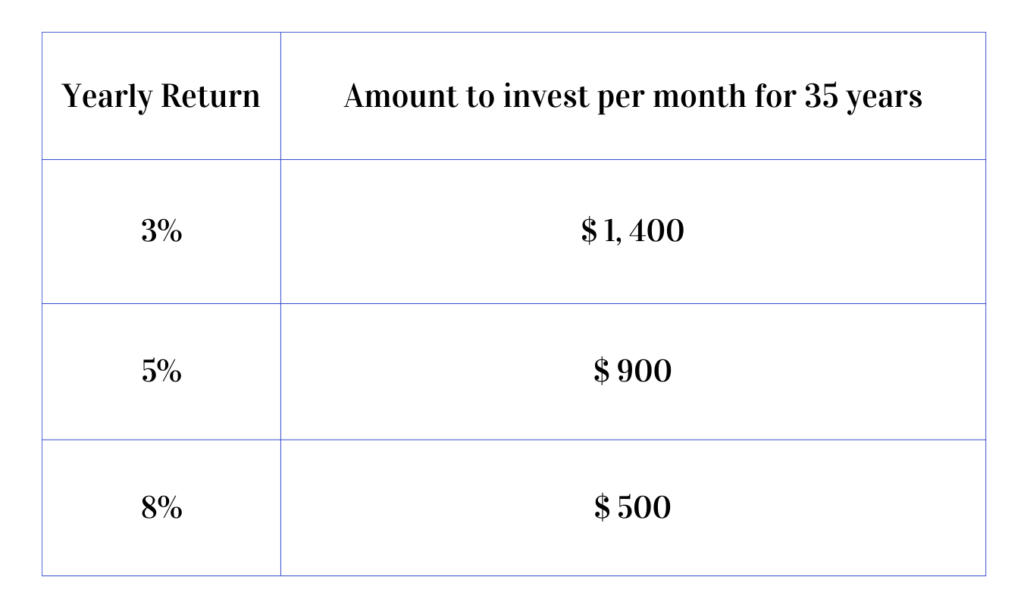

Assuming that you are starting with zero savings, here’s a breakdown of how much you need to save and the rate you need to invest at:

This means that if you are 30 years old now, there is a high chance that you can become a millionaire by 65 years old if you’re able to set aside $1400 per month and invest consistently at 3% every year.

Think you can do better? Then, $500-900 per month may be enough.

But i know what you’re thinking. “Ok this sounds complicated and I don’t have the time and expertise to find out where to invest at 3% or more. So the best thing I can do is to leave it to financial advisors/robo-advisors right?”

Short answer: No.

If you want high returns and you are interested in studying individual stocks, this will take up a lot of time and effort. But for the lazy layperson, there are various ways you can do it. From Singapore’s government’s treasury bills to the United States stock market index, you can easily invest your money yourself.

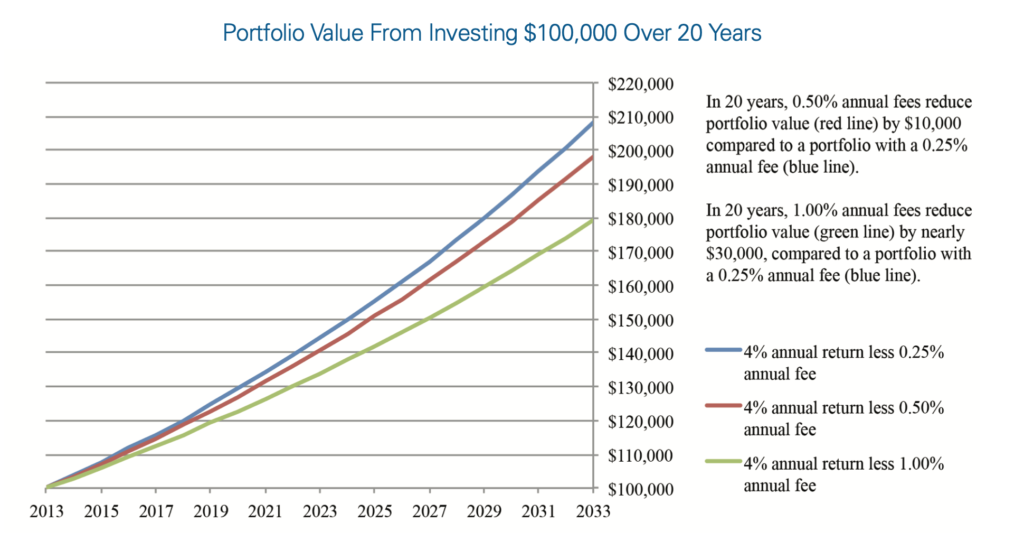

In fact, when you engage financial advisors or robo-advisors, they often just buy these investments on your behalf, and then charge you a service fee. The fees might look small like 0.5-1% per annual, but we forget that the amount compounds and grows exponentially.

Here’s what the fees look like for a modest investment with 4% return.

In 20 years, you may be losing between $10,000 to $30,000. That is 10%-30% of your original money. And this is just on a 4% return. The better your investments do, the more you pay. Think of what else you could have done with the money.

Besides the cost, it is also worth it to do it yourself because taking ownership for your own finances means learning to think for yourself.

Instead of blindly accepting whatever financial advisors say, you become able to judge for yourself if what they say make sense or they are just trying to make more money off you.

What you learn about money and investing can also generalize to other things in life.

For instance, the principle of compounding holds true for many decisions. Studying and upgrading yourself is also a form of compounding. So are healthy habits.

You start thinking about the long-term effects of your behaviours and decisions — How will this pay off not just today, but well into the future?

And this is just about compounding. When you outsource the work to someone, you’re missing out on lessons like this.

That said, sometimes we may feel like we need a bit of hand-holding and guidance and we don’t mind paying more. Ultimately, you are the best judge of your own preference. But building up your financial literacy will help you find out how to best reach your own goals.

“Ok I am convinced. So where do I start?”

From money market funds to unit trusts, there are all sorts of voices claiming that they are a good investments. As a rule of thumb, high returns mean high risks. Because people in finance are shrewd. If something has a high return, it probably means that it’s something that many people do not want to put their money in i.e. higher chance of losing money.

As beginners, it is hard for us to check and verify if they are indeed a good deal. So I would recommend just sticking with the basics: stock market index and some treasury. You can choose if you want to invest in the Singapore market or the US market. The US market offers higher returns but as foreigners, we face potential taxes and some exchange rate risks.

Here are some types of investments that we can make:

1) The Stock Market Index (SG return: 3.8%, US return: 10%, Risk: Slightly higher)

Don’t know which stock to buy? Buy the entire market. This is the strategy recommended by Warren Buffett and is the benchmark that many people use to check if their financial advisor or wealth managers are actually performing better.

Past data has shown that betting on the market growing bigger is better than betting on individual stocks. That said, there is a difference between the Singapore and the US stock market.

Here’s how the Singapore stock index and United States stock index look from 2009. You can literally see how compounding at different rates work out over time.

For the past 10 years, the average annual return of the Singapore stock market index, STI is 3.82% while the US stock market index, S&P 500 return is 11%.

Do note that this is an average number. This means that the returns from year to year fluctuates and can go down in a market crash, or go up by a lot in a strong market. As you can see in the wiggles on the chart above.

In general, the longer you are able to remain invested, you are likely to come out earning a profit. So while history suggests that you are likely to make money via the stock market index, you have to be willing to stomach some potential losses.

This means making sure you have sufficient cash for daily expenses, emergency funds lasting 6 months or more and other future needs. As the saying goes, bad luck comes in threes. When does a stock market crash? Probably in a bad economy. What else crashes in a bad economy? Jobs, salaries. Being over-invested in the stock market could mean losing your savings when you need them urgently. And you can’t afford to wait things out because you have mouths to feed.

This isn’t to discourage you from investing in the stock market. What is important is to make sure you can weather the downs so that you can remain invested when the stock market recovers when the economy recovers.

Read: How (Not) to Lose All Your Savings

2) Mixture of stock index and treasuries

One way to cushion the shock from the stock market going down is to put some cash in stocks and some cash in treasury.

3) Treasuries (SG returns:3-4% , US returns: 4-5%, Risk: Very Low)

If you cannot tolerate any losses, e.g. if you need to pay your student loan in 3 years time or you’re already in retirement, consider treasuries, also known as Treasury bills(T-bills) or bonds.

T-bills refers to short term lending that is less than one year. They are one of the safest investments around because governments can print out more money to pay you back so there’s almost no risk. Bonds are longer term lending which can last from 2 years to 30 years depending on the ones you get. Longer bonds are considered risker because inflation and other risks could erode the value of your loan/bond.

Besides buying Treasuries directly with the government, there are also exchange-traded funds(ETFs). They trade like stocks but own Treasuries instead of shares of companies. They can make it easier for you to own Treasuries especially if you’re lazy to keep up with the bidding of T-bills, etc.

The “right” way to invest…

is the one that works for you. Different people tolerate risks differently and have different uses for money. If you feel miserable trying to hit a certain savings target then it probably isn’t the right one for you. What matters is being consistent and building a savings habit.

And please start small, especially if you’re just starting out and trying to get a feel of how things work. This way, even if you make some mistakes, the pain will be manageable.

Above all, compounding will take time. Let it take its course.

Read more

- Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

-

Here’s How Much it Costs to Buy T-bills versus SGOV ETF on IB

Be careful the type of bonds you buy!

You’re more likely to invest in these bonds via funds like unit trusts or ETFs which help to invest on your behalf. But please make sure what kind of things these unit trusts or ETFs are investing on your behalf.

Some companies offer very high return on their corporate bonds. There is a simple reason for this: they are more likely to go bankrupt and miss their payments. If you’re lucky, sometimes you get a percentage of your money back, if you’re unlucky you can lose even your original investment.

The finance industry likes to call these bonds “high yield bonds”(not to be confused with high grade) instead of “junk bonds”.

So make sure you know what you or your investment manager is actually buying before you put money in these!