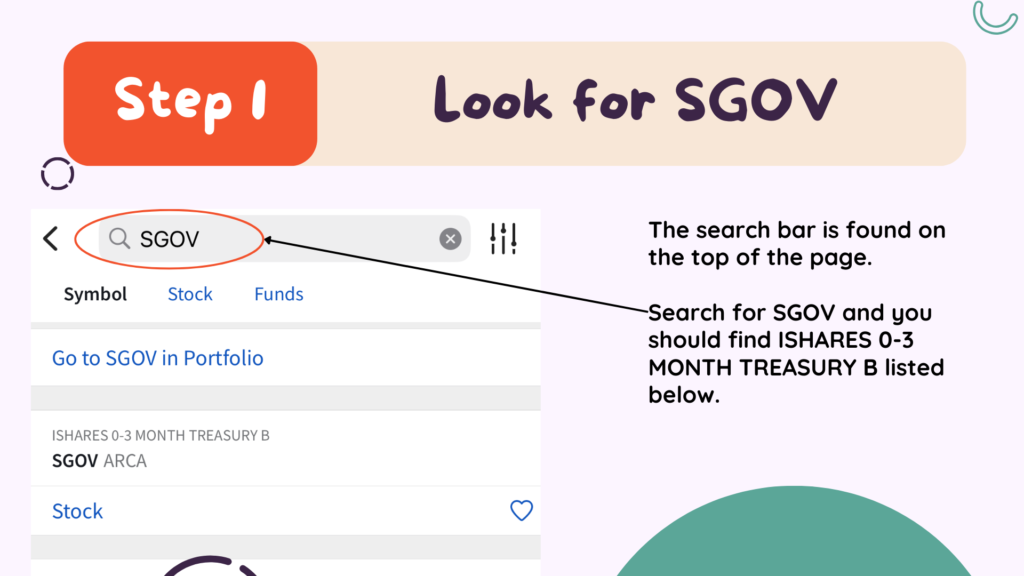

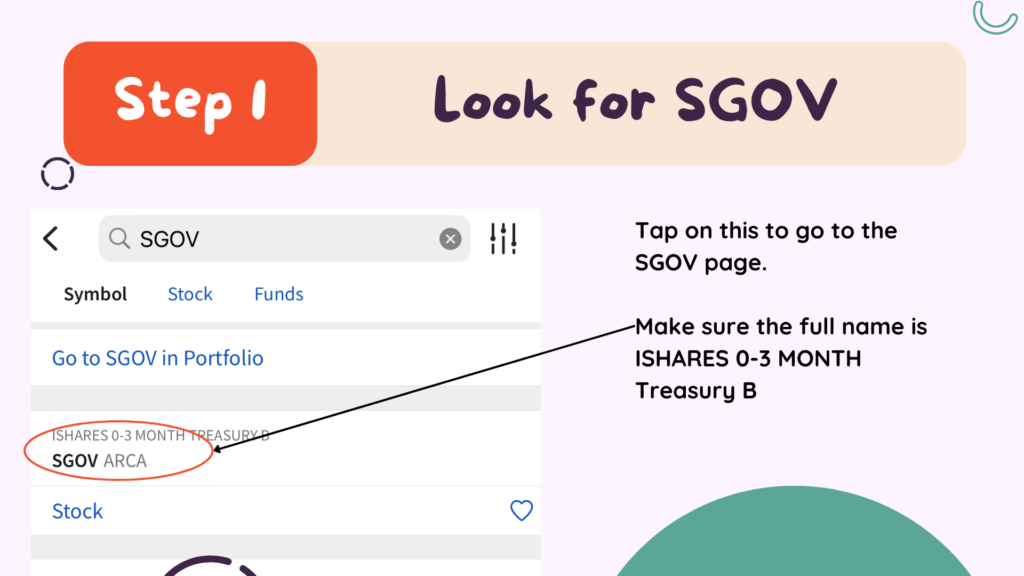

Here’s what you need to do:

- Once you log in the Interactive Brokers(IB) mobile app, tap on the magnifying glass icon on the top right hand corner. This will expand the search bar and you can start searching.

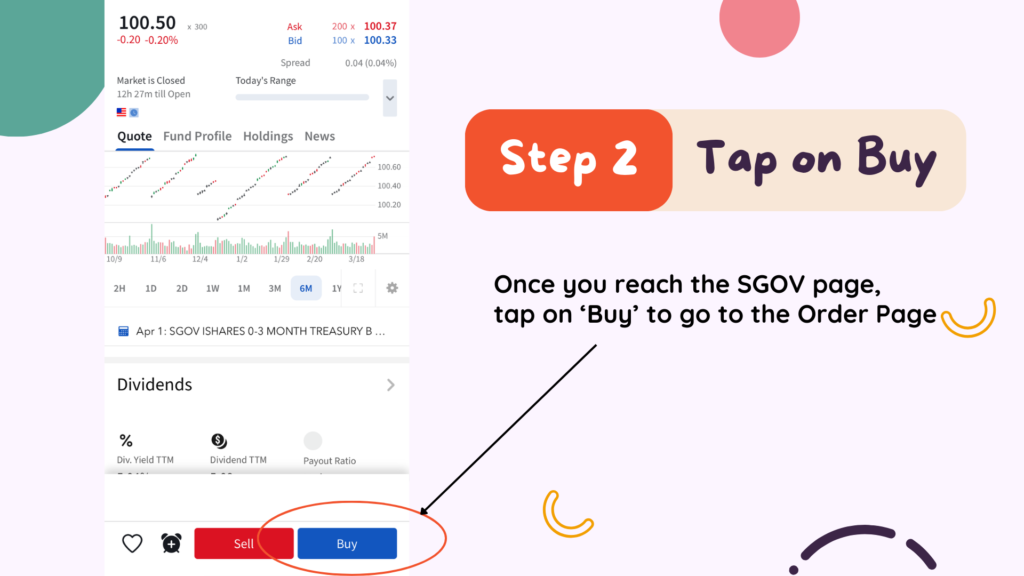

- IB will show you some details about SGOV. You can scroll through to take a look. Do note that the prices on IB are not in real time. This means that although the current price may say $100.50, the latest transaction may actually have taken place at $100.30. And it takes a while before IB will update the price on the platform to show $100.30.In order to get the real-time price on IB, you have to pay a monthly subscription. But you can actually real prices from sites like Yahoo finance. For SGOV, prices are not volatile, so it’s not a big deal for us.

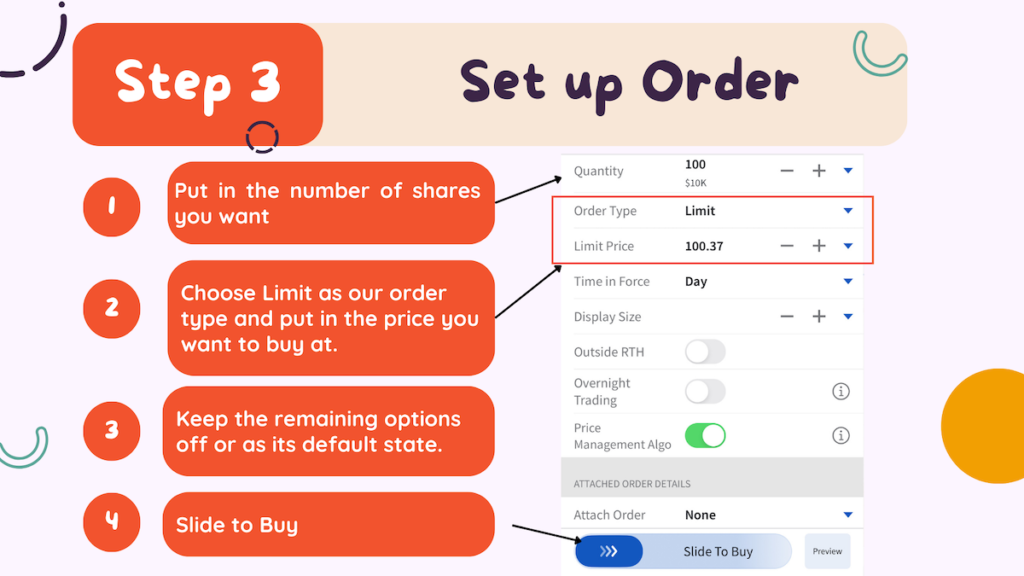

- Follow the steps below to set up your order.

Skip ahead to Step 4 if you are not interested in what the fields mean.

Definitions

Quantity = (The amount of money you have) / (the price you’re buying)

e.g. $100,000 / $100 price = 1000 shares

Order Type: How you want to buy the shares.

- Limit: to buy at the price you want

- Market: to buy at existing market rate i.e. the lowest a seller is selling at

E.g. If you put a buy limit order at 100.50 but the market is at 100.70, the order will not execute until prices drop to 100.50. If you put in a market order, the order will execute immediately regardless of price.

Market order can be more risky if prices suddenly change, but useful if you want to buy it immediately.

Time in Force: the period of time that orders are valid

- Day: order is cancelled by the close of the trading day if not executed

- GTC: Good-til-cancelled, order is valid until cancelled by you

Read more here on IB.

Display size: For concealing the size of your order

e.g. you want to buy 5000 shares of XYZ but want the market to see an order for 200 shares

This can prevent people to jack up prices when they see someone wanting to buy a lot.

Note that your order must be a limit order for this to work.

Outside RTH: Outside regular trading hours

U.S. stock market exchanges—particularly the New York Stock Exchange (NYSE) and the Nasdaq—are typically open between 9:30 a.m. and 4 p.m. Eastern Time (ET). Trading outside of this period, the pre-market and after-hours sessions can be more expensive because there are less people trading.

Overnight trading: similar to Outside RTH

Price Management Algo: programming by IB to help you buy at lower prices

e.g. If you put a buy limit order at 100.50 but the market is at 100.30:

– without the algo, IB will buy at 100.50 for you.

– with the algo, IB will buy it for lowest price available, 100.30

In other words, your limit price sets the max price you are willing to buy, and IB will execute as long as market prices are below what you specify.

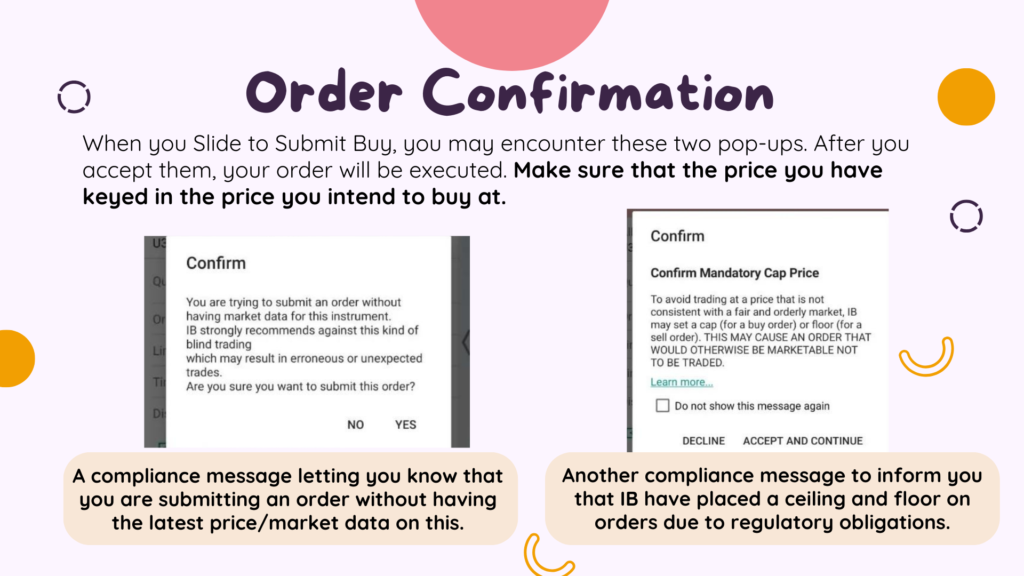

- After you slide to buy, you will come across some compliance messages that you have to agree to continue. Use this chance to make sure that the price you have keyed in is the price you intend to buy at.Don’t underestimate the damage fat fingers can have.

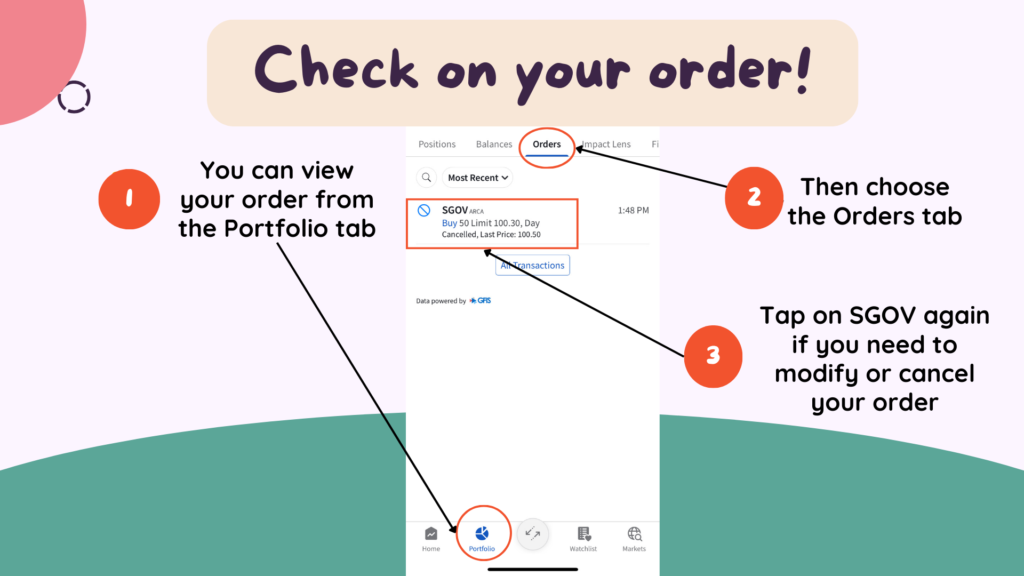

- After you have successfully submitted your order, you just have to wait for the order to fill or complete! You can view or modify your orders by following the steps below.

- Order filled! is the message that IB will send to notify that your order has been executed. Sometimes, it may say ‘Partial fill’. Just wait a bit longer for IB to find other sellers to buy from.Alternatively, you can modify your limit price higher to increase your chances of finding a seller.

Now you can have it and wait to collect interest payments every month!

Read more:

- This is How Much You Can Make Doing Nothing Everyday

-

Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

-

Here’s How Much it Costs to Buy T-bills versus SGOV ETF on IB

Disclaimer:

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.