*If this is your first time here, read this.

If you have extra cash at hand, this is what you should do right now

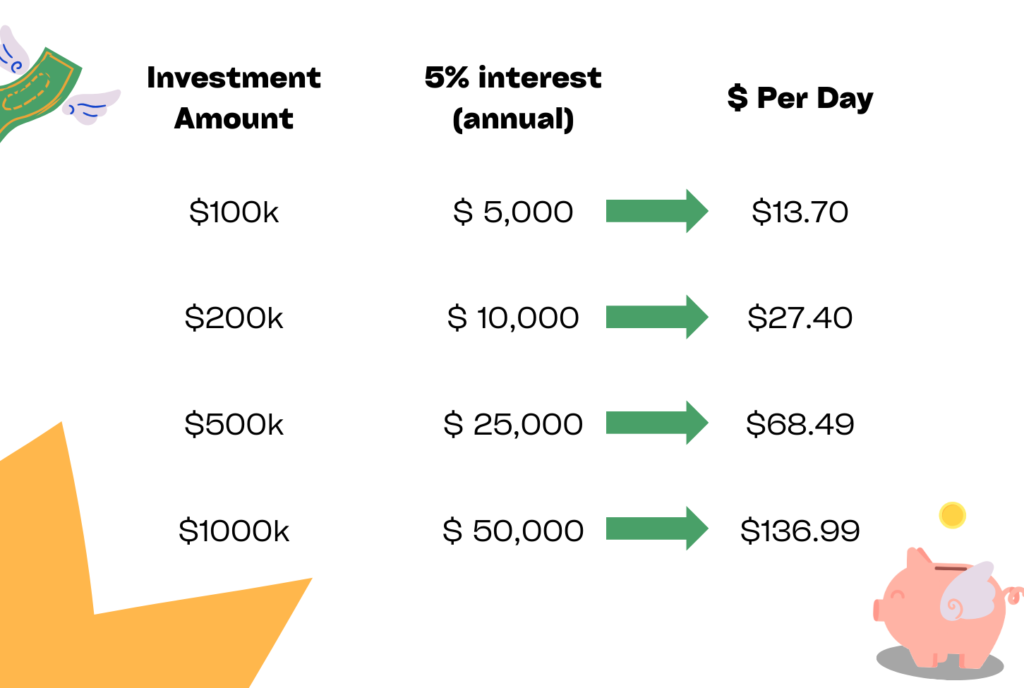

Depending on how much cash you have at hand now, this is what you can make every month, doing nothing, at almost zero risk.

That’s enough to cover groceries or gas, utilities, and more. Without lifting an extra finger. And if you have a million dollars, you can get a 4k monthly salary without actually working.

While you can easily earn this 5% interest on a high-yield savings account with a bank, banks start reducing the interest they pay out once you exceed 100k.

So what can you do if you have more than 100k?

The best alternative for lazy smart investors i found is $SGOV, the ETF(exchange-traded fund) that holds short-term treasury bills. Imagine buying shares of a company that collects money from investors like you and lend it out to the US government. The current yield for lending money to the US government is 5%. The catch? The US government may not continue paying out interest at 5%.

But the current high rates with almost no risk is something you should take advantage of while we can. Especially if you’re someone who worries about losing your money in the stock market and just want something stable that gives you a reasonable level of interest over time.

The best part? You can always sell and withdraw your money if you need it and you don’t have to pay taxes on the dividends you receive!

4 steps to get started:

- Find the lowest cost stock brokerage.

If you’re from Singapore, I recommend Interactive Brokers, or IB (I’m not paid anything to say this). Why? Because almost all Singapore brokerages charge too much. Newer platforms/apps also only tend to offer temporary commission-free transactions. What’s more, IB offers the lowest/zero foreign exchange fee when you make your currency exchange.

- Transfer your funds to your account.

- Search for SGOV. Convert your currency and buy the amount you need.

- Sleep and let your interest grow every month!

Other things to note:

- IB will tax and refund you your interest around February every year. Why? Typically, the US taxes foreigners on income made from US. However, SGOV is exempted from that. So IB will make the refund at the end of the tax term in US.

- Alternatives like IBTU has the benefit of not having to wait for the refund, but average volume is relatively lower versus SGOV. This may cause a problem if you need to sell your shares quickly but there are not enough buyers to take them off your hands. So pick and choose which is more suitable for your needs.

- The price of SGOV will rise as they get interests from the Tbills, and drop when they pay out the dividends. So even if you have to sell and withdraw before the dividend is distributed, you actually still get the interest on it as the price would have rose relatively to the beginning of the month.

- SGOV currently has the lowest expense ratio among all the short-term treasury etfs but it may expire in June 2024. So please keep a lookout!

Read more:

- Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

- This is How Much You Can Make Doing Nothing Everyday

- Here’s How Much it Costs to Buy T-bills versus SGOV ETF on IB

- How to buy SGOV on Interactive Brokers for Beginners

Disclaimer:

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.