*If this is your first time here, read this.

If you have ever owned a Treasury bill (T-bill) before, you probably know this.

The problem: You forget about buying them again after it matures.

A simple solution is to set up some sort of reminders on your calendar. But you would still need to bid for them. This takes up time.

Call me lazy but I prefer to skip all of these.

So i decided to find an ETF that does the dirty work of re-purchasing new T-bills whenever existing ones come due.

And of course, there’s no free lunch.

So how much would that cost?

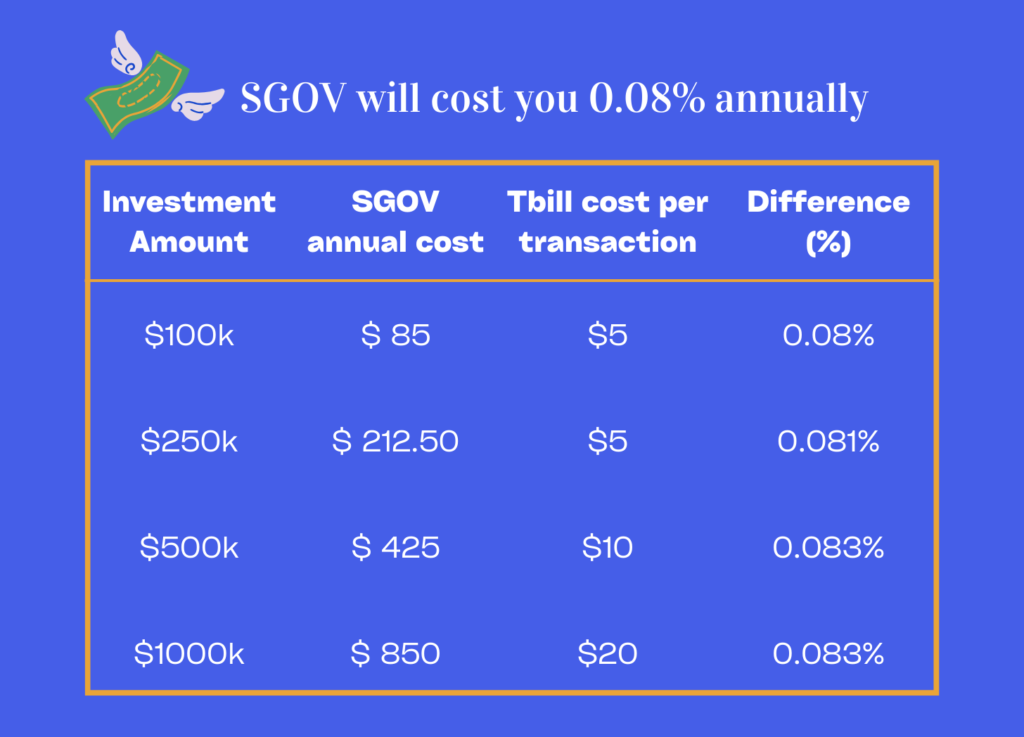

To compare, I chose the iShares 0-3 Month Treasury Bond ETF(SGOV) which tracks U.S. Treasury bills with <3 months maturity.

And because I’m not a US citizen, I would need to buy T-bill on the secondary market.

Here’s the breakdown for each option:

(Scroll till the end if you would like to know how the numbers are calculated!)

In general, being lazy will cost 0.08% of my investment annually.

Is it worth it?

To be fair, 0.08% is similar to a low-cost index fund.

And the low T-bill cost per transaction? Because the investment sum is quite large, I am not sure if I can find enough T-bills to buy within a single transaction. This will reduce the cost difference between a bond ETF and buying the T-bill on its own.

In addition, I get a monthly payout instead of waiting 6 months or longer. This means I gain the flexibility to either reinvest that money or use it on something else.

And if something happens and I need to cash quickly?

A bond ETF like SGOV allows me to redeem your investment almost immediately on the market. In contrast, it is harder to sell bonds because there are less buyers and sellers around.

All in all, it seems reasonable to pay up 0.08% for a lazy way to invest in T-bills.

That said, different T-bill ETFs have different costs so make sure to do your own calculations before you buy any of them!

Read more:

- This is How Much You Can Make Doing Nothing Everyday

- Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

- Why SGOV Out of So Many T-bills ETFs

- How to buy SGOV on Interactive Brokers for Beginners

For those interested, here’s how I got the numbers.

- T-bill

Assumption: Only buy once and hold until maturity. If you’re buying two 6-months T-bills in one year, multiply by 2.

Minimum fee: $5

Commission: 0.002%* Face Value

Total cost: $5 if investment < $250,000, else equals to commission

- SGOV

Assumption: Buy and hold for one year

Minimum fee: $1

Commission ( IBKR Pro – Fixed rates): USD 0.005 for shares ≤ 300,000

Number of shares = Investment value / $100 per share

Net Expense Ratio (ER): 0.07%

Spread: 0.01%

Total cost = Commission + ER + Spread ≈ 0.08%

Disclaimer:

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.