*If this is your first time here, read this.

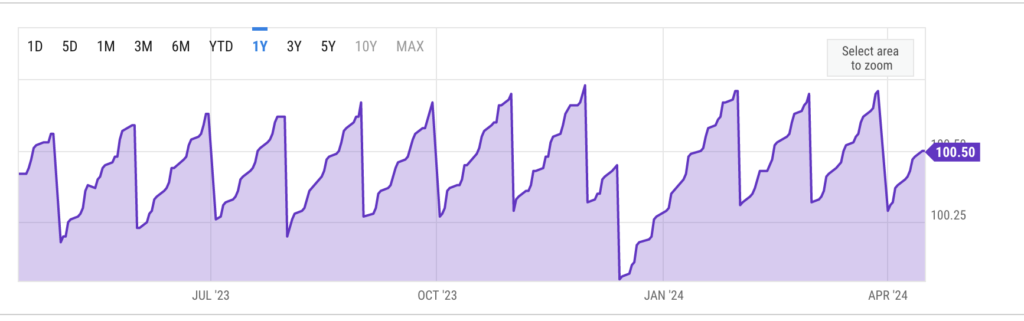

This is the one year price chart of SGOV.

Source: https://ycharts.com/companies/SGOV

You will notice that its price rise gradually and then immediately drop to a new level. What is going on? Should you worry?

Here’s what I found out after doing some research.

Some basics about SGOV

SGOV, is the ticker code for the exchange-traded fund iShares 0-3 Month Treasury Bond ETF. (If you don’t know what is ETF, please check out my other article before continuing.)

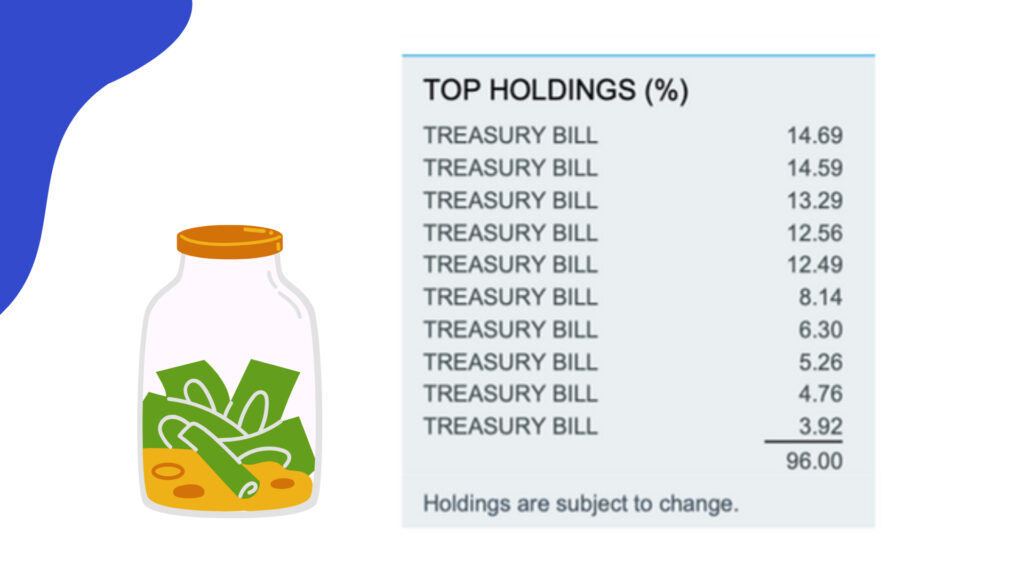

Just like any other ETF, when you purchase a share of SGOV, you are essentially passing your money to the fund. The fund then takes your money to buy short-term treasury bills (T-bills) that come to due within 3 months or less. You can find the breakdown of the T-bills the fund has bought on iShares website.

Here’s the latest snapshot I took today. These are T-bills with different maturity dates.

By purchasing a share of the ETF, you get to collect the interest that comes when the T-bills come due. It is also called distributions and paid out monthly.

On the ex-date, the fund will record who currently hold shares of the ETF. For SGOV, it is the first work day of the month and the payment day is one week later.

In the meantime, the fund will hold on to any interests it collects.

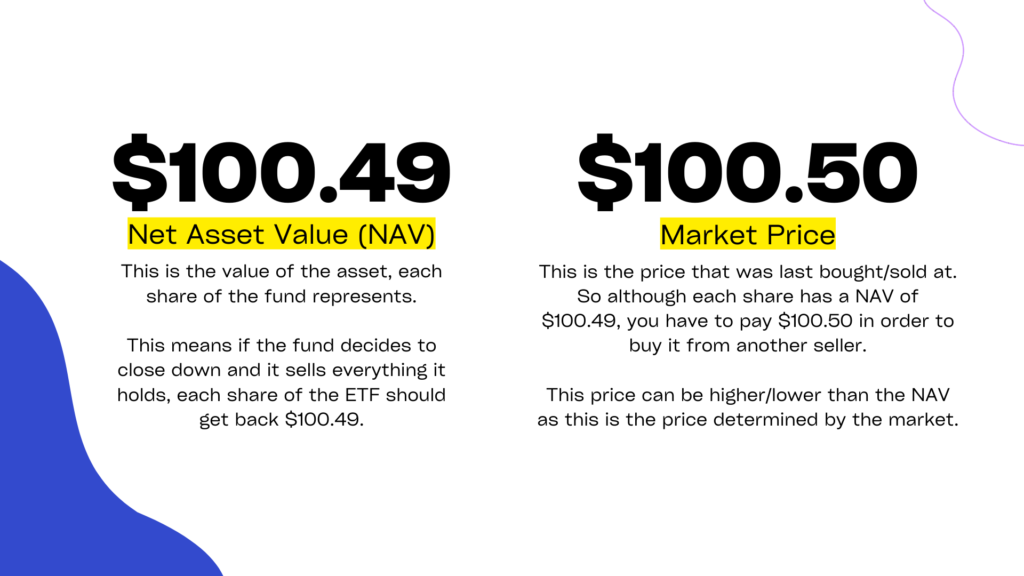

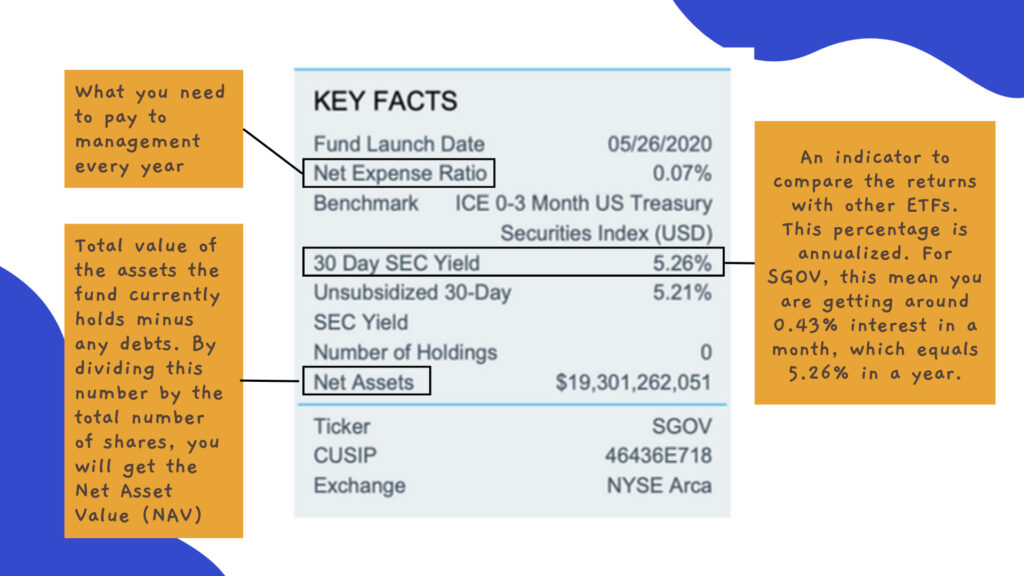

This increases the fund’s asset value. When you divide the total asset value (after deducting liabilities) by the total number of shares, you get the Net Asset Value(NAV) per share. If one day the fund decides to shut down and sell everything, you should be getting back this amount for every share you hold.

Theoretically, this is also the price you should be paying to own one share of SGOV. But in the real world, sometimes you need to provide some kind of incentive to get sellers to sell it to you. So if you look at the latest market price, you can see that it’s actually $100.50, which is $0.01 more than NAV.

(Price as of 17 April 2024)

Most of the time, the market price will track the NAV closely because buyers don’t want to pay too much of a premium. And this is why you see the price of SGOV increasing gradually as interest accrues towards the end of the month and dropping off after it pays out its dividends.

Q: What happens if I buy it the day before the interest got disbursed, and sold it the day after?

To keep our example simple, I am going to assume that you do not have to pay taxes on the income you receive from SGOV and ignoring transaction costs.

Let’s say you bought a share on 28 March 2024 for $100.72, and sold it for $100.29 on 1 April 2024. The transaction would result in loss of 43 cents per share. However, you would still receive the distribution payment of 45 cents per share, resulting in a gain of 2 cents per share.

Q: Should I wait until after the ex-date to buy SGOV?

Similarly, if you bought a share today at $100.50 and the price falls to $100.29 on 1 May 2024, it might look like you lost 21 cents per share. But you will still receive the full distribution income.

And because you are holding SGOV for lesser number of days rather than the whole month, it is natural that you’re receiving slightly lesser in absolute income.

So you don’t actually lose money even when you buy close to the ex-date. But if you’re uncomfortable seeing a temporarily “loss” on your portfolio, there’s no harm waiting for a while.

Do what is comfortable for you.

Q: Am I losing money if I sell before the ex-date?

One benefit of investing in an ETF instead of holding the T-bills directly is you can redeem your money when you need it back by selling on the market quickly. Because the interest accrued is usually reflected in the market price, you still get the income by selling at a higher price.

SGOV Risks – Could you lose money on SGOV?

T-bills are considered risk-free investments because the United States government can always print more money to pay you back. That said, you can read some of the potential risks on SGOV’s prospectus.

In my point of view, these are very low risks which I am comfortable with.

Some other terms that you might be interested to know

Read more:

- Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

- Where to Stash Your Cash? SG T-bills vs US T-bills

- Here’s How Much it Costs to Buy T-bills versus SGOV ETF on IB

- How to buy SGOV on Interactive Brokers for Beginners

Disclaimer:

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.