*If this is your first time here, read this.

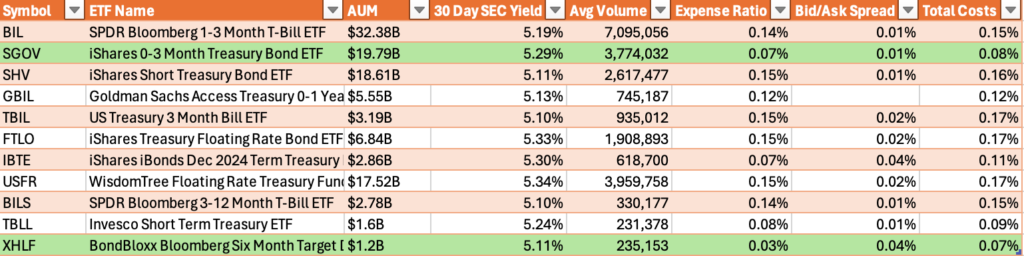

A simple search online would generate a long list of ETFs that hold short-term US Treasury bills (T-bills).

Why do I think SGOV is better?

To be honest, most of these short-term Tbills ETFs are going to give you similar returns. Although ETFs with floating rates(interest rates that adapts to the latest rates) and shorter term T-bills are doing better recently, their performance will get worse when rates fall off later.

What really differentiates SGOV from the others boils down to just two costs:

Expense ratio and bid-ask spread

Expense ratio is the yearly fee you pay the fund management for running the ETF. But what the heck is ask-bid spread?

Here’s what each word mean on their own:

- bid: the price buyers are offering to buy.

- ask: the price sellers are looking to sell at.

- spread: this difference between the bid(buying price) and ask(selling price)

If this sounds a bit confusing, let’s go through a simple example.

Imagine that you’re at the auction market for apples. Here’s the market prices:

- Bid price: $0.90/apple

- Ask price: $1.10/apple

To buy an apple now, we have to pay $1.10 because this is the price that apple owners are looking to sell at. If we already have an apple and trying to sell it, we can only sell it for $0.90. This is because currently buyers are only willing to pay $0.90 for an apple.

This is bad because we make a loss of $0.20 although we are buying and selling the same thing! In terms of spread, this means a whopping 18% (0.20/1.10 = 18%)!

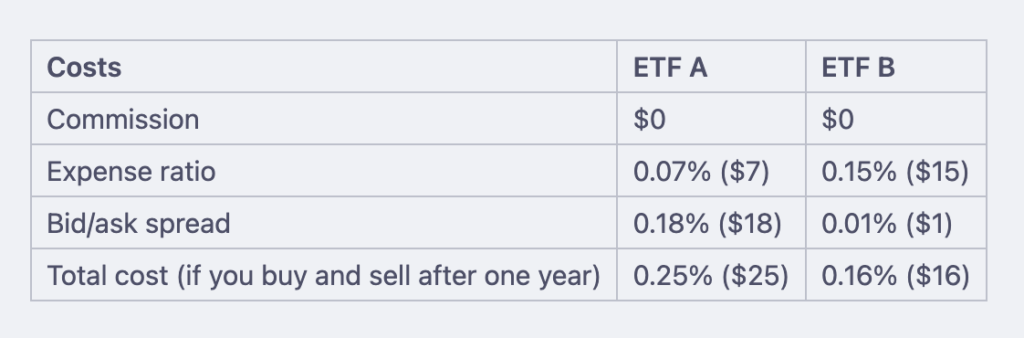

Comparing bid/ask spread and expense ratio for two ETFs

Let’s compare costs for two hypothetical ETFs assuming a $10,000 purchase for a year.

At first glance, it would appear that ETF A is cheaper because of its lower expense ratio.

But if you look at bid-ask spreads, you’d realize that ETF A has a much larger spread than ETF B. This means when you buy ETF A and later sell it, you will incur 0.18% transaction cost compared to ETF B’s 0.01%. When you take both costs into account, ETF B is actually the cheaper one.

Typically, wide spread happens when there are few buyers and sellers in the market. As a result, bigger funds have an advantage because they have the ability to attract and ensure there’s enough buying and selling within the fund.

Expected Returns – Total Costs = Net Return

Some might argue that the bid-ask spread is not important for passive investors as we are not trading actively and can wait for a favourable rate before we sell. But at times when we need the cash urgently, we have to take the market rate. An ETF that is able to keep its spreads tight will get more points from me.

In sum, after taking these costs into account, I find that SGOV has the best net return.

Do note that bid-ask spread may change from time to time, so remember to check it before you actually press on the ‘buy’ button!

If you’d like to know more about SGOV, check out these articles below:

- This is How Much You Can Make Doing Nothing Everyday

- Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

- Here’s How Much it Costs to Buy T-bills versus SGOV ETF on IB

- How to buy SGOV on Interactive Brokers for Beginners

Side note: When I first did my research, XHLF had a bid-ask spread of 0.18% ($50.23-$50.14). However, things seemed to have improved recently as the Bid-ask spread has fallen to 0.04%. If XHLF can continue to keep its spread tight, it could be a good choice for investors too!

Disclaimer:

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.