Your financial advisor probably don’t want you to know this.

Investing in a low-cost index fund may be the closest thing to a free lunch in stock investing. You don’t need to worry if you’re investing right, monitor the markets or even study businesses and their accounting. Yet, you get to make more money than most professional investors.

If this sounds counter-intuitive, you’re not alone. To find out why, let’s break down what each term mean.

Grab a cup of coffee and let’s go.

1) What is an investment fund?

A fund takes in money from different people to invest. Some of the things they invest in are stocks, bonds, real estate and even commodities.

In this article, we will just focus on funds that invest in stocks.

In general, there are two types of funds, private or public.

Briefly, private investment funds are reserved for people with millions because they can afford to lose them. The things that their fund managers invest in are typically higher in risks but they also promise higher returns (and higher fees). Some examples of private investment funds that you read on the news are hedge funds, private equity and venture capital.

But most of us will only be interested in the public investment funds like mutual funds and exchange-traded funds(ETFs). These are meant for the general public, and investors are protected somewhat by the government rules and regulations put in place.

Mutual funds are run by fund managers who decide what to invest on behalf of the fund. In contrast, ETFs are mostly run by computer programs and do not pick stocks. Just like on a shopping spree, they buy all the stocks that make up the index they track.

2) What is an index?

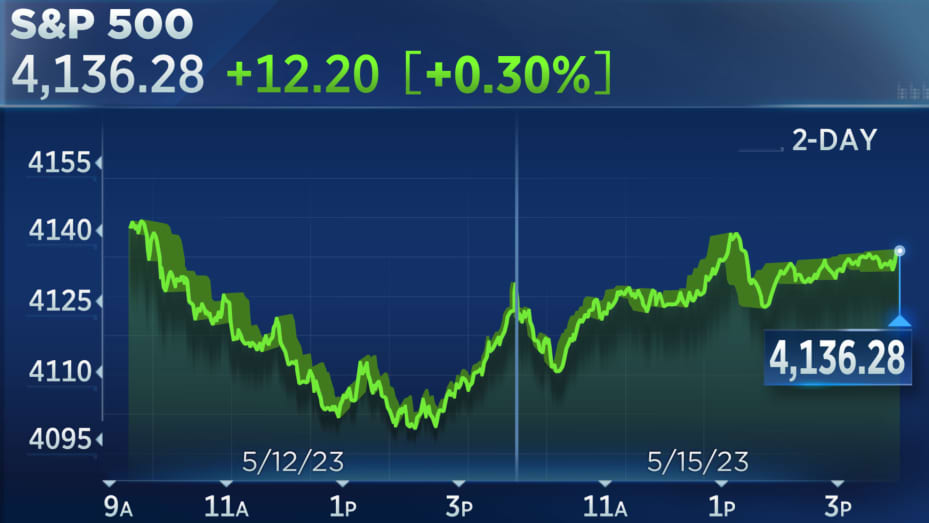

For many of us, this is what we imagine in our heads when we think of the stock market.

That is actually the stock index.

Just within the United States, there are over thousands of public companies are listed on the stock exchanges. It is difficult, if not impossible to get track of each and every of them.

The solution? You guessed it right. We do it through the stock index.

Like the thermometer telling us the temperature, the index tell us how ‘hot’ the stock market is performing with a single number. By adding up a large number of companies and dividing them, stocks with strong performance are even out by those with weaker performance. This gives us an average measure of how the overall market is performing.

There are many different indexes but one frequent index you will come across is the Standard & Poor 500 (S&P 500). It measures the top 500 largest companies on the US stock exchange.

3) Most ETFs are index funds.

When you buy a share of that ETF, you are investing in all the largest 500 companies in the US.

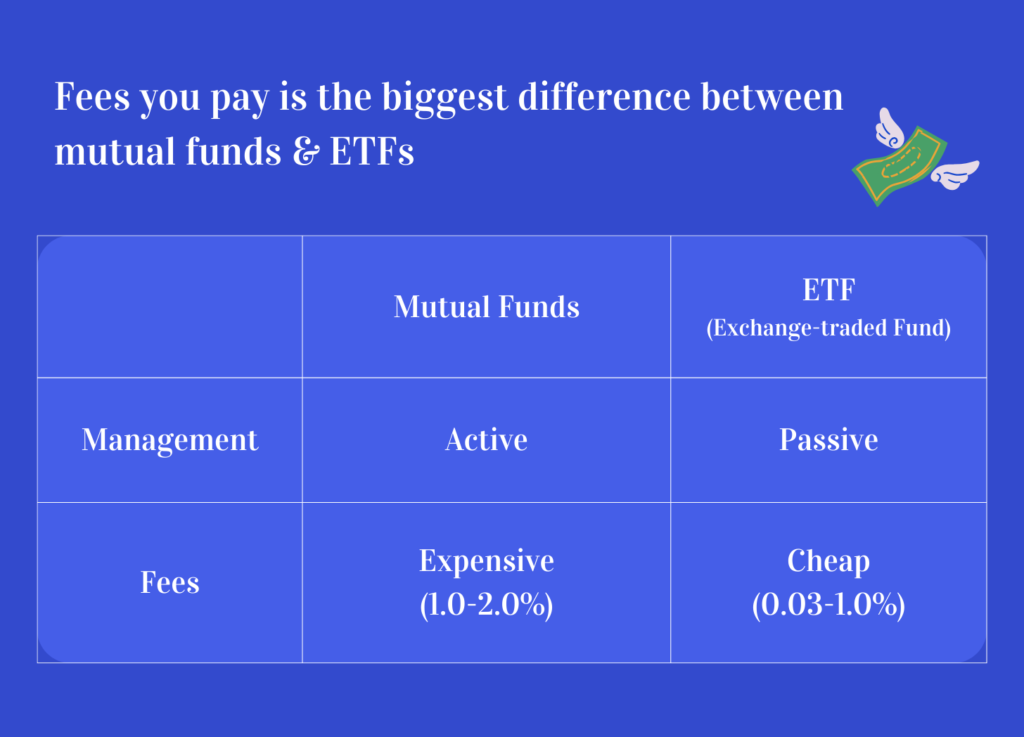

4) Mutual fund vs index fund

Some of the fees that you typically have to pay includes,

- Entry fee: when you first join the fund

- Expense ratio: A yearly fee you pay the manager to invest your money. 1% expense ratio per annum means that each year, 1% of the fund’s total assets will be used to cover expenses.

- Yearly custodian fee: to pay a 3rd party bank to keep your money safe in case your fund runs away with your money

- Early Redemption fee: a penalty fee when you want to take out your money early

- Redemption fee: when you want to leave the fund

Just the yearly fees will add up to around 1-2%.

In contrast, the fees for an ETF are cheaper because it doesn’t require a manager. Some of the fees include:

- Expense ratio: the annual fee you pay to the fund for operating expenses

- Commission costs: just like buying a stock, you need to pay the stock exchange and broker fees, but it is free on some platforms

Low-cost fund fees can be as low as 0.03%.

Here are the top ETFs and their respective expense ratios.

5) The Case for Mutual Funds

In theory, fund managers are professionals skilled in picking up good companies that will grow in size.

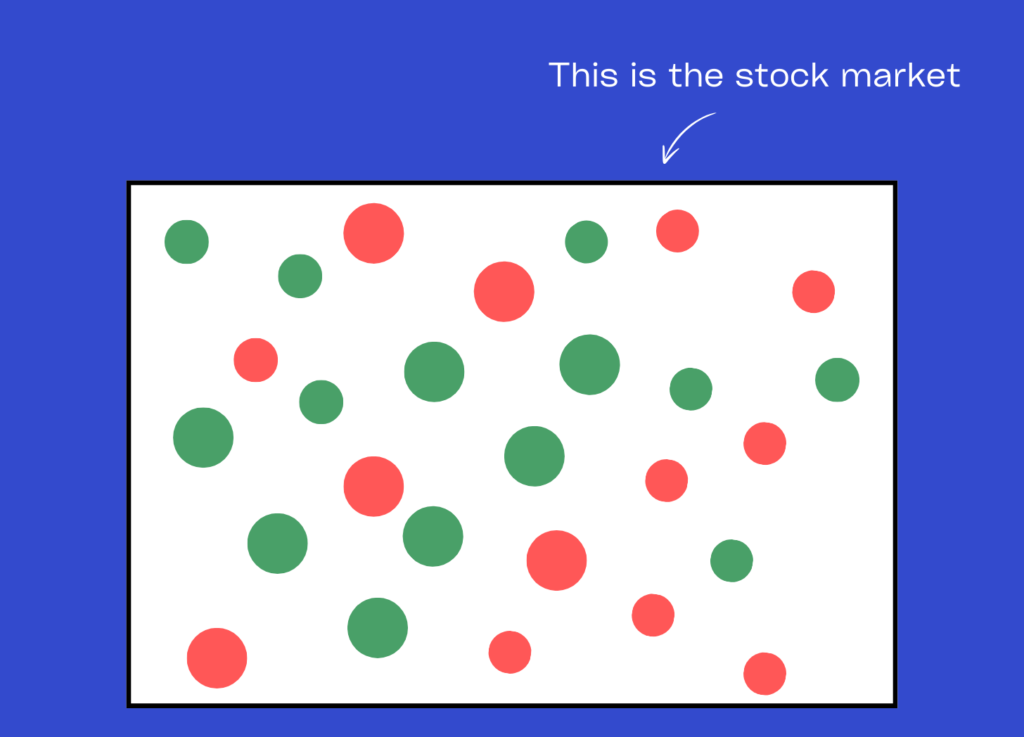

Imagine that the rectangle below contains all the stocks on the stock market.

It contains both ‘good’ companies (green) that will make more money and ‘bad’ companies (red) that will lose money.

Good investors should be able to tell the good from the bad companies apart, by studying the business and the trends in the economy.

The stocks they pick should therefore return more money compared to the market average, the stock index which adds up both good and bad companies.

6) The case for low-cost index fund

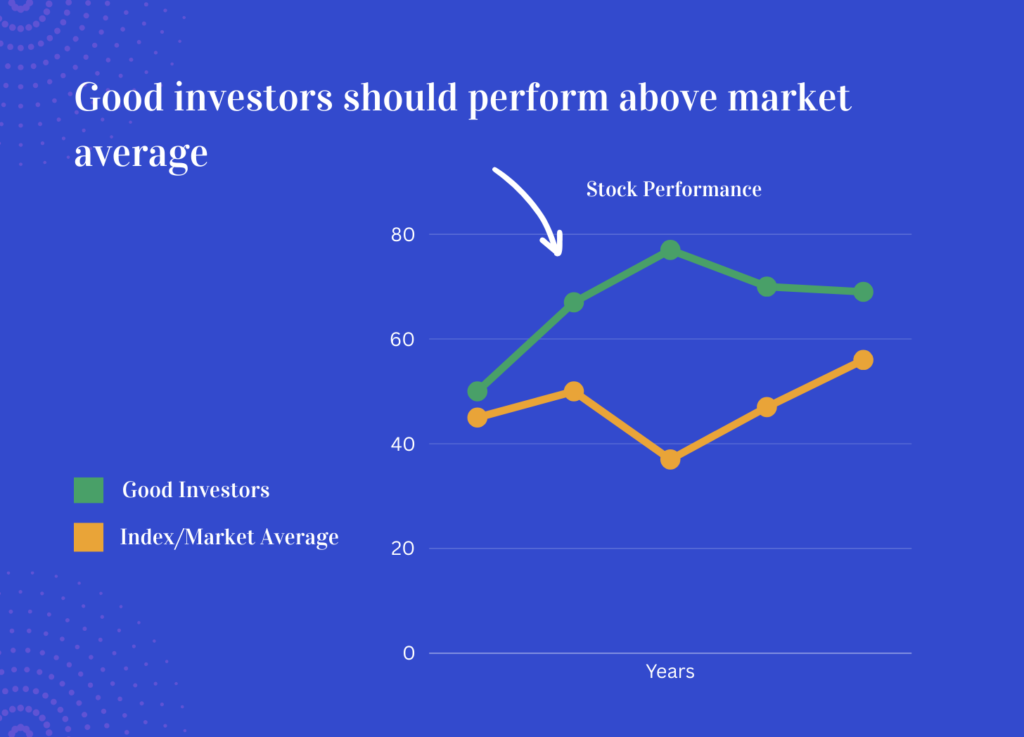

Here is what reality looks like.

If you had invested in an average fund rather than the low cost index fund, you would make 23% less, or roughly $40k less in our example below.

(The black line is the S&P 500 index. The green line is the returns of the index fund. The red line is the return you get when you invest in an average fund that has an investing manager that helps you invest your money. )

Which brings us to the question:

7) Why does the average fund lose out to the low cost index fund?

It’s the fees.

But it’s only 1-2%! Why does it make such a big difference?

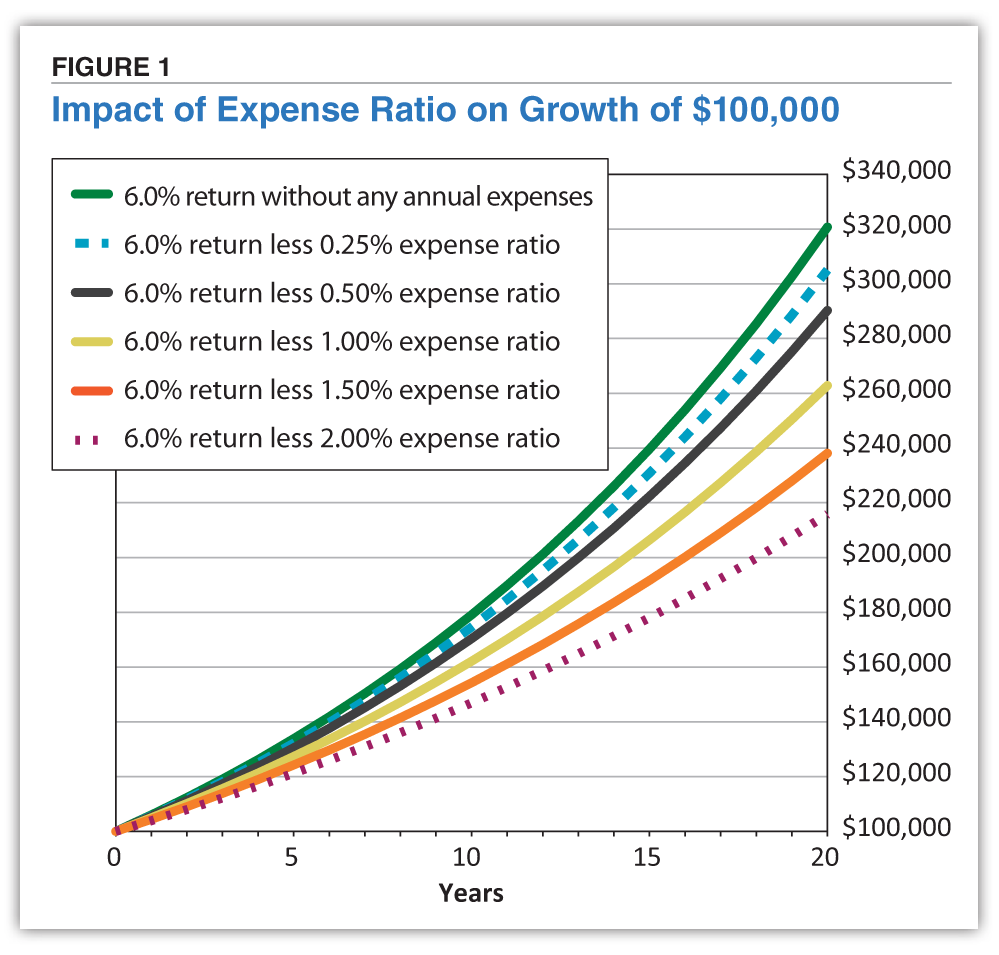

When money grows with interest, it snowballs into a large sum over time.

When you project out a 100k investment over time, on a modest 6% return, 1% expense ratio will take away 40% of your initial investment.

Source: https://www.aaii.com/journal/article/13214-understanding-mutual-fund-fees-and-expenses

And remember, you have to pay the fees before they even help you to earn any money, if they do.

Many people find out the hard way when their investment go awry and their dream of a prosperous retirement reduced to dust.

8) Does this mean there’s no way anyone can beat the stock market?

Of course, there are exceptions. Roughly around 10% of funds do beat the stock market. Some high expense funds also have above-average returns for many years. However, they won’t take your money unless you are part of their inner circle, eg. classmates, personal family/friend, etc. Why benefit strangers when you can benefit people you know?

Likewise, not all ETFs are safe investments. Some ETFs are expensive and will give you poor returns or even cause you to lose money.

What’s most important is making sure you’re paying the right kind of fees for the kind of returns you’re expecting to get.

If you want an investing manager, make sure they provide a better return than the cheaper index fund over the long term. Make sure the return is calculated after deducting all fees and dividends because some funds will “massage” their returns to show better results when it doesn’t.

For lazy, smart investors, who don’t want the hassle, the go-to option is a low-cost index fund.

That said, if you think the stock market is too risky for you, the alternative is to invest in bonds which we’ll talk about next time!

Word of the Week:

Read more:

- This is How Much You Can Make Doing Nothing Everyday

-

Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

-

Here’s How Much it Costs to Buy T-bills versus SGOV ETF on IB

- How to buy SGOV on Interactive Brokers for Beginners

Disclaimer:

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.