*If this is your first time here, read this.

Are all your eggs held in one basket?

Think about where most of your assets and cash is held in. From our monthly income to the humble abode that we stay in, most of us are reliant on a single market or currency for our income, and investments. When things are going well, there isn’t much to worry. By investing only in our own country, you avoid currency risk and even enjoy tax benefits. As markets are increasingly globalised, the benefits of diversification seems minimum.

Yet, this home country bias puts us in a critical risk: overexposure to a single country’s politico-economic conditions.

Read also: An Important Lesson About Risk

Hedging against Black Swan Events

In 2007, Nassim Nicholas Taleb, a finance professor and famous Wall Street trader popularized the idea of a black swan event — events that are deemed impossible to happen, but have catastrophic consequences when it does occur. Examples include the disruption caused by COVID-19, the 2008 Financial Crisis.

Before these events actually happened, most people do not believe that these events would actually occur. As a result, many are unprepared for the catastrophic consequences when the events occurred. Taleb argued that it is important for people to always assume a black swan event is a possibility and make plans in its eventuality.

And this is why it is important do diversify.

While we can’t predict if Singapore will continue to do well (e.g. opposition takes over and fails to govern well, populism takes over), by allocating some of our cash and financial assets in a foreign country or currency, we can spread our risk and return to some extent.

US Treasury Bills (<1 year)

Beyond the option of the US index funds, stashing cash in US Treasury bills/ETF offer an easy and risk-free way for the layperson to diversify. It also enhances our potential return by capturing the benefits of different interest rate levels with 1-year US Treasury rates at 5.4% versus Singapore’s 1-year Treasury rates at 3.55%.

Some might argue that interest rate parity and currency exchange risk make this investment unappealing. But here’s how I see it.

- Failure of uncovered interest rate parity

(This is a more technical discussion for people who learnt a concept called the uncovered interest rate parity. Those unfamiliar with it, please skip it.)

Uncovered interest rate parity is a financial theory that suggests that when countries have different interest rates, traders will buy and sell the respective currencies until any potential gain in interest is offset by negative foreign exchange rate movement.

While the mathematics and logic works out, the bulk of empirical evidence suggests that it usually does not hold and has been reported in many studies (also known as the Fama puzzle).

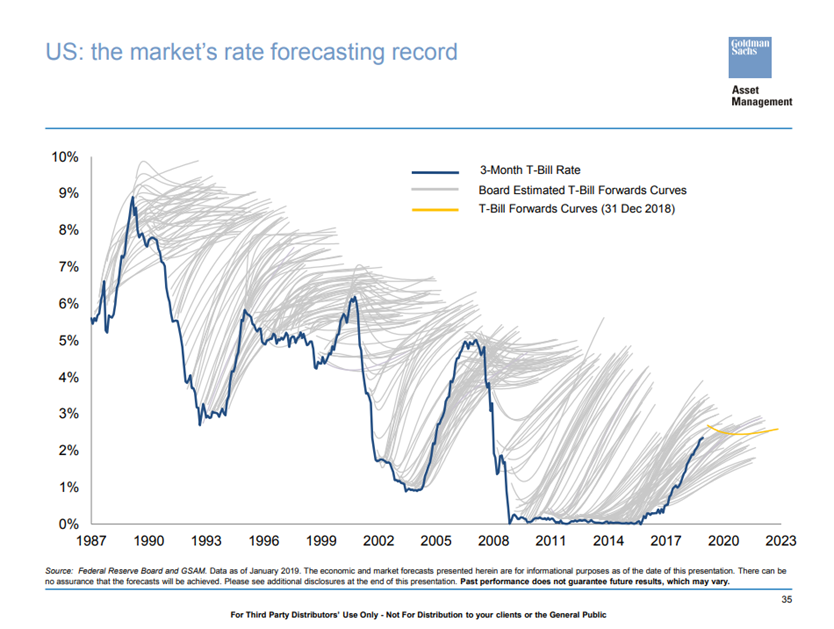

To get a sense just how hard it is to get future interest rates right, here’s the record of Goldman Sachs analysts over 25 years period. The dark blue line is the actual rate, the grey lines are the predictions.

(source)

If we can’t even predict interest rates 3 months later, can we really predict the exchange rates?

- Currency exchange risk?

Singapore’s exchange rate is managed. Essentially, the SGD is pegged against the currencies of our major trading partners, which United States is one of them. And you can see USD/SGD has traded over a tight range(1.3-1.45) over the years.

So where does this fear of currency exchange risk come from? A guess would be the 1997 Asia Financial Crisis when many investors got burned for investing in high-interest yielding foreign currencies. But the critical difference for USD-SGD is that both are stable and mature economies.

Furthermore, given the size of our economies, Singapore’s economy will likely suffer along with United States if anything happens to US, but US probably won’t feel much of an impact if anything happens to Singapore.

But perhaps more importantly, since we are looking to hedge our exposure to a single country, currency exchange risk is a feature, not a risk.

Takeaways

There is no perfect investment. Even cash faces the risk of inflation. If you currently have some cash looking for a home, US Treasury bills or its corresponding ETFs might deserve a closer look.

Read more:

- This is How Much You Can Make Doing Nothing Everyday

-

Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

-

Here’s How Much it Costs to Buy T-bills versus SGOV ETF on IB

- How to buy SGOV on Interactive Brokers for Beginners

Disclaimer:

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.