*If this is your first time here, read this.

Taxes.

You’d think that you can avoid them if you’re a foreigner. Unfortunately, when there’s money to be made, governments love to have a share.

Many beginner investors get a shock when they find out the ‘missing’ money they were expecting went to the governments of their home country and the country of the asset they hold.

Before we find out how we can avoid or minimize them, here are three types of taxes you need to know when investing.

Capital gain tax

Capital gains refers to the profit you make when you buy and sell an asset like a stock or real estate.

Luckily, if you do not stay in the US for 183 days or more in a calendar year, you don’t have to pay.

Another good news for Singaporeans, the SG government does not have a capital gain tax policy too so you can keep all your gains!

Withholding Tax on Dividends or Income

While Singapore does not have a withholding tax policy, the United States taxes foreigners when you receive income from a U.S. source.

This includes dividends and interest earned on securities issued by U.S. companies, U.S. registered mutual funds (as well as interest earned on U.S. Treasury and Government agency securities but they’re not taxed).

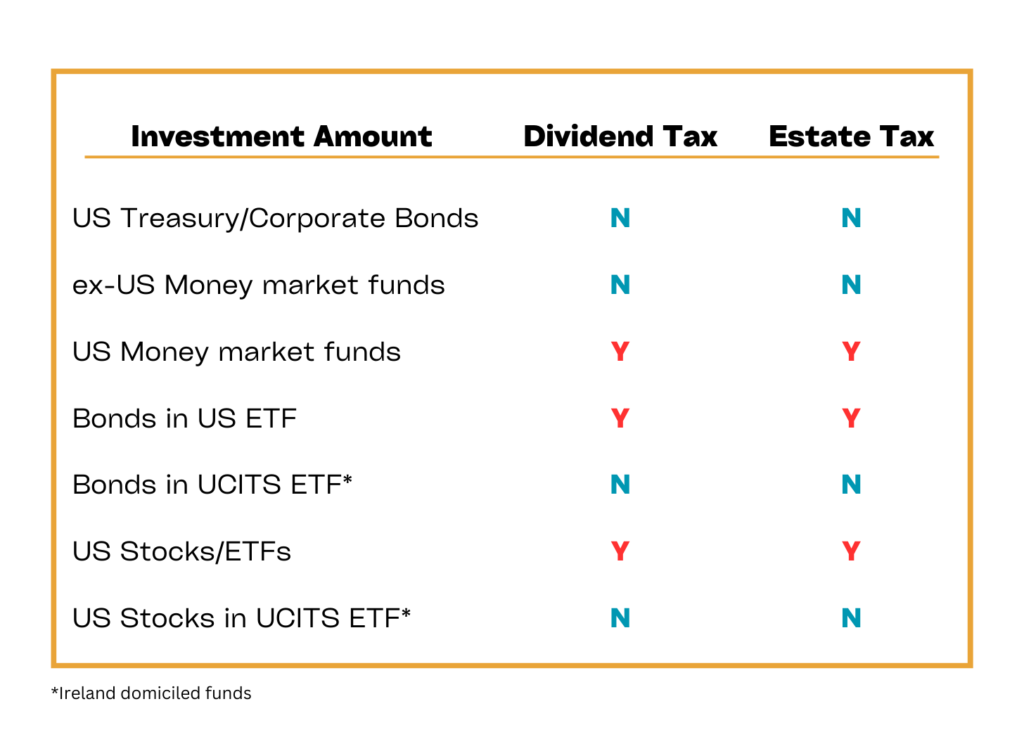

Here’s a breakdown of the kind of investments that are subjected to US taxes.

Depending on the tax treaty between your home country and the U.S. you may be taxed differently. For Singapore investors, we have to pay a 30% tax on all dividends received.

This means for every $100 dividend we get from stocks or investments in the US markets, we will only receive $70.

Perhaps the only good thing about this 30% tax is that it is automatically deducted by our brokerages, so we don’t have to do anything more to pay the taxes (*cries in silence).

Side note: If the dividends are paid by foreign companies e.g. Singapore registered but listed on the US stock exchange, interest-related dividends or short-term capital gain dividends, they’re exempted from this withholding tax!

US estate tax (up to 40%)

This is basically inheritance tax. If you have US assets like stocks/mutual funds(including money market funds)/cash in US brokerage accounts, the US government will take a cut when you pass on. While it seems quite remote, you don’t want to be caught unprepared when life hits us with a curveball. If your parents or grandparents have US assets, make sure they’re aware of this estate tax too.

How to Avoid/Reduce Withholding Tax/Estate Tax

- Invest in Treasury or Corporate bonds qualifies as “portfolio interest”

In general, interest earned on bonds and commercial paper issued by U.S. companies, U.S. Treasury and by U.S. government agencies are considered “portfolio interest” and are not taxed. (That said, there can be exceptions!)

For Treasury/bond ETFs, regulated investment companies are allowed to exempt a portion of their distribution to non-U.S. shareholders. However, the dividend exemption rates vary across funds and investment companies.

So always check before you invest!

- Ireland domiciled exchange traded funds (ETFs)

These are ETFs registered in Ireland and they are liable to a 15% dividend withholding tax due to the tax treaty between US and Ireland.

Ireland domiciled ETFs are also not subject to the estate tax.

However, expense ratios/bid-ask spread might be higher. They are also listed on the London Stock Exchange. So be sure to calculate both to see which works out better for you!

Conclusion

If you’re looking for income from US assets, Treasuries and bonds are a better option. Alternatively, Ireland domiciled ETFs can help you to save some taxes, but make sure their expenses make it worthwhile.

If you’re interested, you can find out

- the dividend withholding tax in different countries here.

- whether your home country has a tax treaty with US here. If you can’t find your country in the list, you’re considered to be under ‘Non-treaty’.

Read more:

- This is How Much You Can Make Doing Nothing Everyday

-

Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

-

Here’s How Much it Costs to Buy T-bills versus SGOV ETF on IB

Disclaimer:

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.