*If this is your first time here, read this.

Is IBKR offering a risky free lunch?

You might have come across blogs or forum posts that tells you that you can avoid paying for currency conversion fees on Interactive Brokers(IB) through the feature ‘Recurring Investments’.

And in the world of finance, where platforms charge a myriad of fees that eat away at our returns, it sounds too good to be true…

So here’s what I found on their currency commission page.

A Sure Fee or A Risky Gain?

While it is true that IB doesn’t charge you a commission fee for the auto-currency conversion, they can actually charge you on the exchange rate.

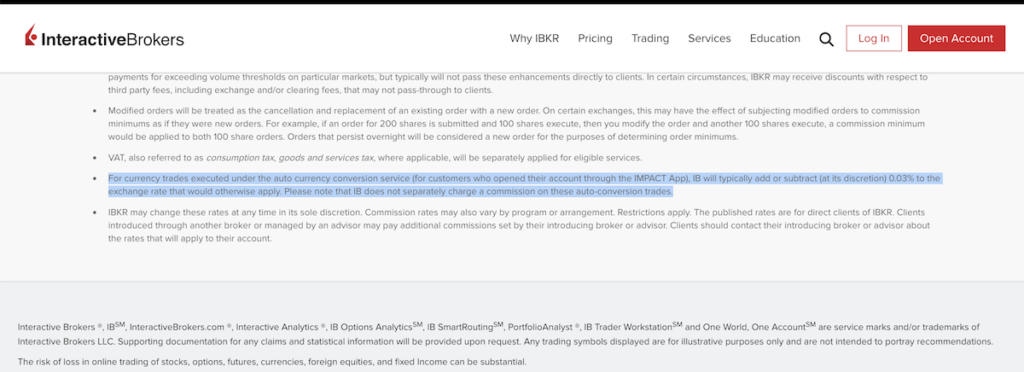

Here’s the small-print at the bottom of the page that most people missed:

“For currency trades executed under the auto currency conversion service, IB will typically add or subtract (at its discretion) 0.03% to the exchange rate that would otherwise apply. Please note that IB does not separately charge a commission on these auto-conversion trades.”

In other words, you will not see a commission charge on your IB statements, making it looks like it’s free. But IB may still charge you by converting the currency at a higher exchange rate than the market exchange rate whenever they like.

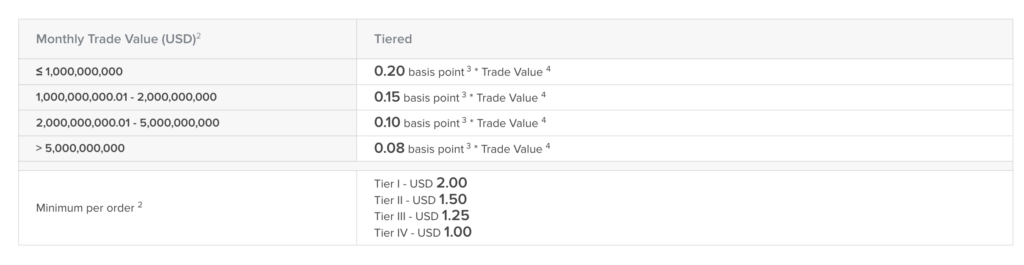

In contrast, a typical currency conversion will cost around 0.002%, with a minimum $2 per order.

(Note: One basis point is equivalent to 0.01%)

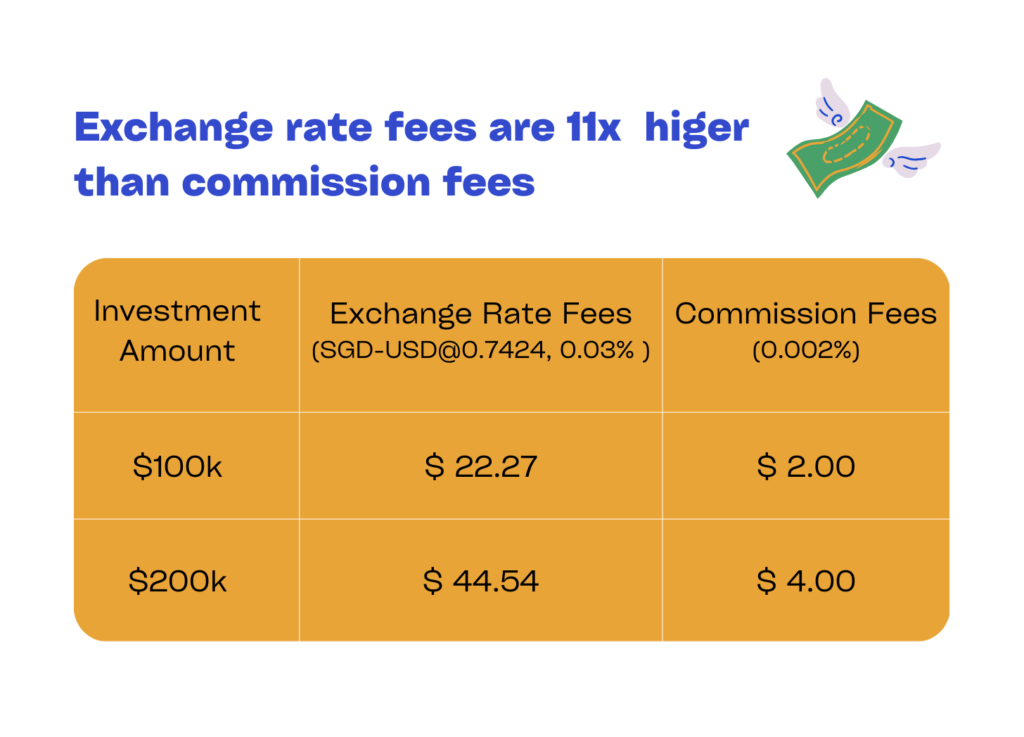

As an example, I’ve calculated how much you have to pay for SGD-USD conversion at existing exchange rate and commission rate.

Here’s what you will pay for each option:

For single transaction less than ~SGD10k, it will be better to opt for auto-conversion. At 0.03% exchange rate, it is cheaper than the $2 currency conversion minimum fee.

But for passive investors who make few but large orders, our conversion orders (>100k) will exceed the $2 minimum, so the commission we pay is just 0.002%, which is just a few dollars. In contrast, the exchange rate fees are 11x more, reaching twenties dollars or more.

What makes the auto-conversion method attractive though is that IB does not make it clear when they will charge an additional 0.03% exchange rate fee for auto-conversion.

So if you’re lucky, you may be able to get a ‘free lunch’. But rather than risk the discretionary charge, I feel safer paying for the extremely low commission fee.

Read more:

- This is How Much You Can Make Doing Nothing Everyday

-

Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

-

Here’s How Much it Costs to Buy T-bills versus SGOV ETF on IB

- How to buy SGOV on Interactive Brokers for Beginners

Disclaimer:

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.