Decomplicate your investing decisions

On 19 December 2007, Warren Buffett, the legendary investor, made a surprising announcement.

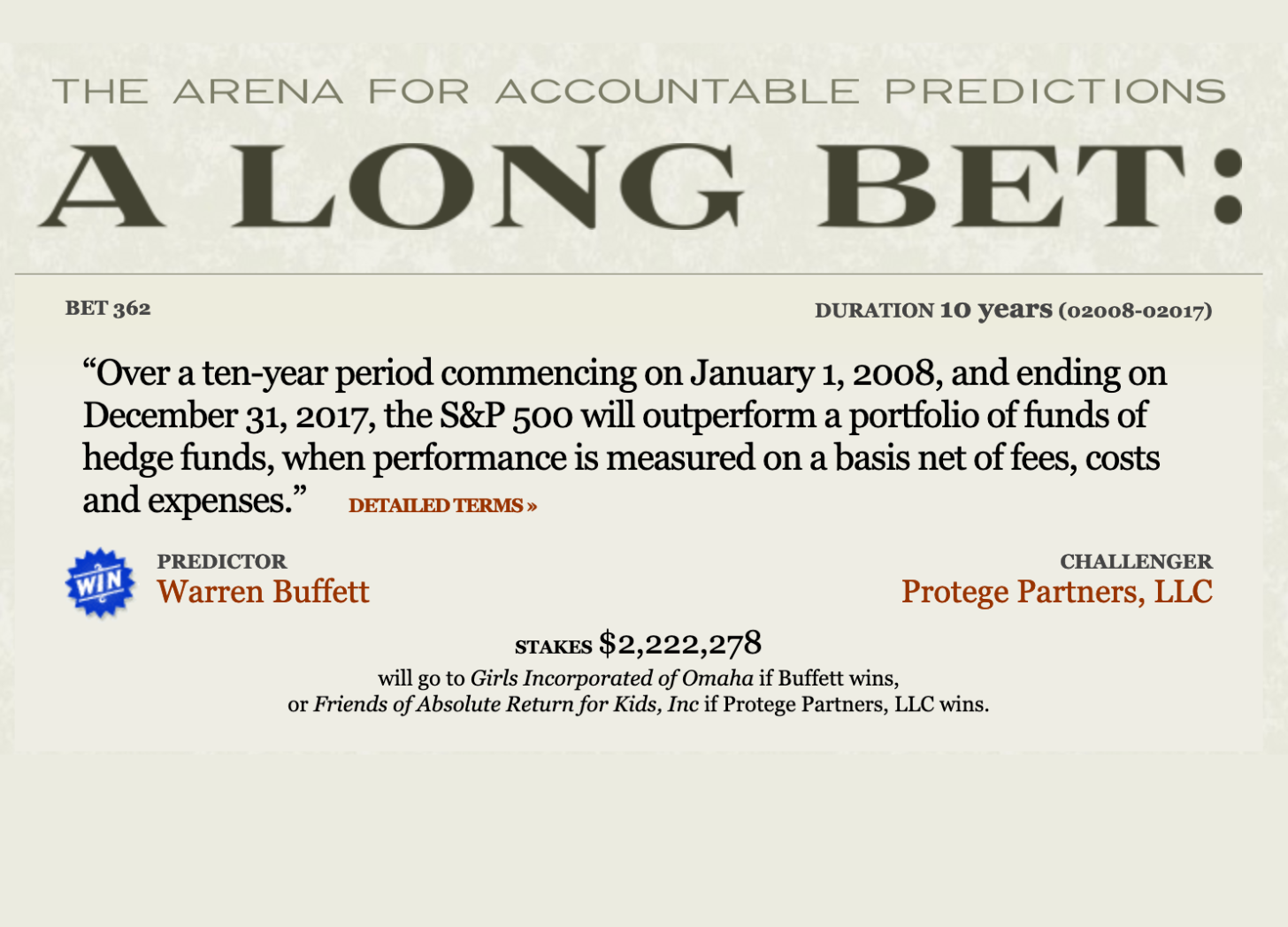

He is offering a 1 million dollar bet to anyone who would take him up. The terms? For the next ten years, professional money managers won’t beat the returns of S&P 500 (the market) after their fees are accounted for. Ted Seides, an ambitious hedge fund manager, took up the challenge.

The bet is on.

What’s at stake is not the money — after all, the money will go to charity regardless of who wins. But for Buffett to publicly bet money where his mouth lies, it’s a testament that he means what he says. He has extolled the virtues of passive investing throughout the decades as he said at a Berkshire shareholder meeting in 1993:

“By periodically investing in an index fund, for example, the know-nothing investor can actually out-perform most investment professionals. Paradoxically, when ‘dumb’ money acknowledges its limitations, it ceases to be dumb.”

But can that actually be true?

Hedge funds managers, are not your average investors. They are the elite of the elites. They graduate top in classes, have all the research resources that their huge firms carry out for them, and access to the management of the firms that they are investing in. With all the brains and resources behind them, surely, if anyone can beat the market, it should be them. That’s why people with millions and billions hire them to manage their money while poorer folks are stuck with the boring market-tracking ETF.

So Warren Buffett must be making a losing bet, right?

Well, if I’m writing about it, I’m sure you have guessed that no, Warren Buffett won the bet.

Here’s the scorecard released in 2017:

In the first year, the market saw the Great Financial Crisis. The funds outperformed the ETF chosen by Warren Buffett. But, that one year will be the only time that hedge funds outperformed the market. Fast forward ten years, $1000 invested in the passive ETF made you extra $1258. In contrast, even with the best performing hedge fund, would only return $877.

Think about this. More than 40% difference just by doing nothing!

Why the difference? It’s the cost of hedge funds.

Buffett picked the Vanguard 500 Index Fund Admiral Shares (VFIAX) with an expense ratio of just 0.04%. Ted Seides picked five funds-of-funds, with fees averaging a staggering 2.5% of assets. That seemingly small percentage, snowballs with time into a large difference.

And if you had picked the unfortunate Fund D, which actually closed in 2016 before the 10 year period, you would only make a measly $28 over 9 years.

Ted Seides who left his firm in 2015, said two years later, “for all intents and purposes, the game is over. I lost.”

This is not to say no one can beat the market. For all, Warren Buffett himself is a glaring exception. There are some exceptional managers but most of us don’t know who they are and we are often unable to judge who’s actually good. That’s why on average, the best way to invest for the average investor is to stick with a low-cost market tracking ETF, especially in a mature stock market like the United States.

So why doesn’t your financial advisor tell you this?

Career incentives

Sometimes ‘doing nothing’ is the best answer. But can you imagine anyone paying for this advice? People will try to sell you things you don’t need, simply because there’s more money in it for them if they do. This is also known as the principal-agent problem in economics, when the interest of the customers(principal) and advisor(agent) are not aligned.

It doesn’t mean that all financial advisors are out there to lie to you. Sometimes in an effort to be helpful, we overthink things and add complexity to something where simplicity leads to the best outcomes. We think that things would improve if we do more. But like things in life, sometimes the harder you try, the worse it becomes.

Likewise, professional advisors believe their complexity adds value because the alternative is too painful to bear. What’s the point of those stressful long hours if you can’t add value?

Fortunately for the layperson, we have a choice.

Read more:

- This is How Much You Can Make Doing Nothing Everyday

-

Why Choose Interactive Brokers & How to Get Free Shares worth up to USD $1000

-

Here’s How Much it Costs to Buy T-bills versus SGOV ETF on IB

- How to buy SGOV on Interactive Brokers for Beginners

Disclaimer:

Investing decisions are personal. Depending on your personal circumstances and preference, what works for others might not work for you. Be responsible for your own investments. Always invest according to your own needs and preference.